Financing

How can technology and innovation help you with financing your business? Technology and innovation in finance help you access capital more easily, and access finance management software. This software supports businesses to effectively manage their assets, control their cash flow, and maximize the productivity of their projects.

Financial Technology (Fintech)

Fintech is a dynamic sector at the intersection of finance services and technology. In fintech, financial companies provide capital services and products for start-ups and businesses entering new markets. Fintech is changing the traditional value chain in the finance sector.

Fintech is a dynamic sector at the intersection of finance services and technology. In fintech, financial companies provide capital services and products for start-ups and businesses entering new markets. Fintech is changing the traditional value chain in the finance sector.

Fintech: Non-Traditional Funding

Crowdfunding

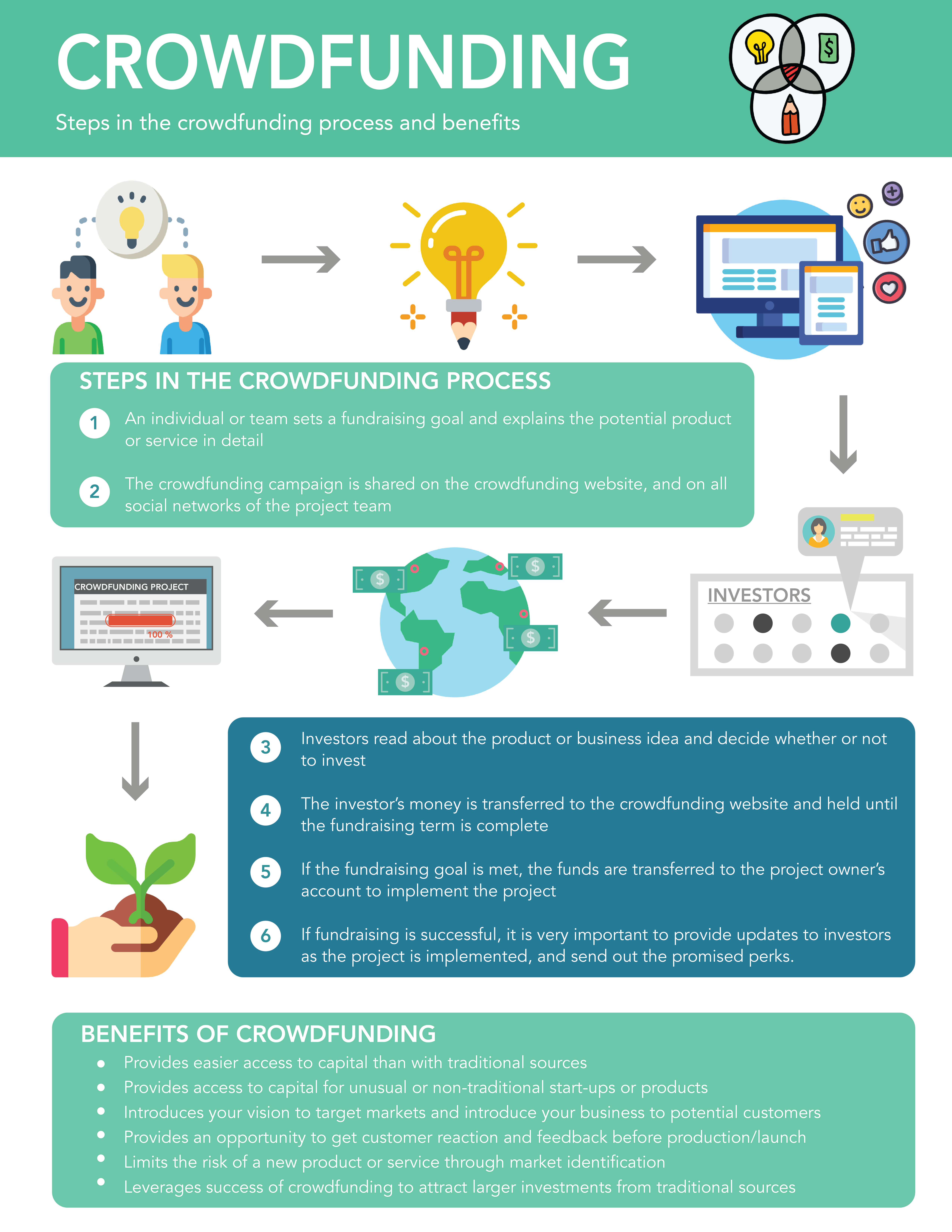

Crowdfunding takes advantage of the larger audience of the web to raise capital for projects that would otherwise have difficulty obtaining funding from traditional banks. Crowdfunding websites make it easy for an average person to invest a small amount in an interesting project. If the business can attract a large number of small investors, it can still raise a significant amount of capital.

Crowdfunding is often used by individual start-ups and for new projects by small businesses. Entrepreneurs use crowdfunding when they are raising capital and as an initial launch funding before looking for larger loans and investors. Attracting a large crowdfunding audience can show that a market exists for a new product, and can refine an idea with market feedback before investing money in production.

Benefits of crowdfunding & Steps in the crowdfunding process

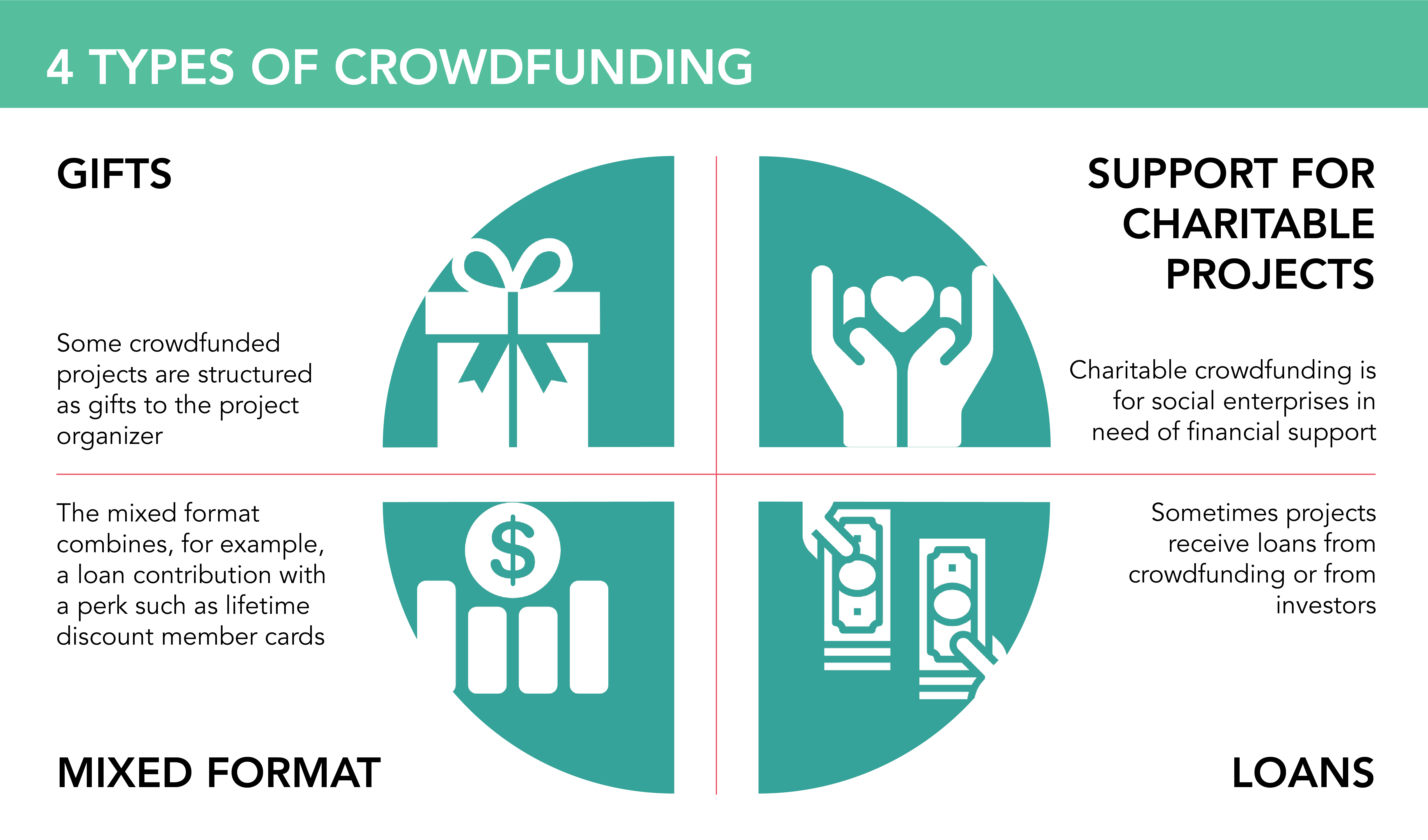

Types of crowdfunding

Crowdfunding websites – international

Crowdfunding websites – Indonesia

- Kitabisa - This platform, which favors social projects, has been around since 2013

- AyoPeduli - Accepts projects in three categories: health, education, and environment

- GandengTangan - Targets social businesses and micro businesses such as smallholding farmers

- Akseleran - Indonesia’s first equity crowdfunding platform

- Crowdtivate - Crowdtivate is a crowdfunding platform from Singapore.

- Mekar – caters to SMEs that produce innovative products

- TaniFund – supports Indonesian farmers

- Modalku - offers loan-based crowdfunding for MSMEs that are located in two big cities (Jakarta and Surabaya) and four smaller cities (Bogor, Depok, Tangerang and Bandung) on the Java Island

Crowdfunding Case Studies:

To date, Crowde has partnered with 300 experienced and trusted farming communities. Crowde has supported some 3,500 farmers in Indonesia, receiving a total of more than US$1 million from more than 8,500 investors.

KitaBisa was one of the first crowdfunding companies in Indonesia. KitaBisa continues to focus on the Indonesian market, with stronger emphasis on Islamic givings. KitaBisa has established partnerships with Islamic charity organizations such as Dompet Dhuafa, Rumah Zakat, and Baznas.

The Ministry of Tourism and Creative Economy has cited Ekuator Games as an example of a company that has successfully used crowdfunding to launch a new online video game.

This Indonesian movie project raised about IDR 311M (USD $32,800) through the crowdfunding site Wujudkan.com.

This building project for an NGO supporting marginalized women collected IDR 54M (USD $5,700) through the Indonesian crowdfunding site Patungan.net.

Peer-to-peer lending

Peer-to-peer lending websites create successful direct connections between people who have money to lend and people in need of loans. These platforms help businesses connect with funding without any intermediary lending agencies.

Steps in peer-to-peer lending

- A business owner or entrepreneur registers an account on a peer-to-peer lending website

- The business owner creates an application, including a time frame and amount for the loan, and a summary of the skills and expertise in the team

- A financial expert from the website appraises the application

- If the application is accepted, the business owner agrees to the terms and conditions of the investment and the interest rate

- The application may be officially accepted with the requested loan amount, but often there will be some conditions for minimum funds raised

- The request for investment is put up on the website, where investors can browse and select from approved investment opportunities

- Website staff handle legal procedures related to the loan agreement for all partners

- The peer-to-peer lending website distributes the loan funds to the business owner, and sets up accounts for the business owner to automatically make monthly payments on the loan

Peer-to-peer lending websites in Indonesia

As described in a January 2018 Reuters online article on fintech firms, soaring smartphone ownership, with more than 100 million smartphones sold in the country of around 250 million people, has fueled the growth of P2P.

Some of the top P2P sites in Indonesia include:

Fintech: Managing Your Money

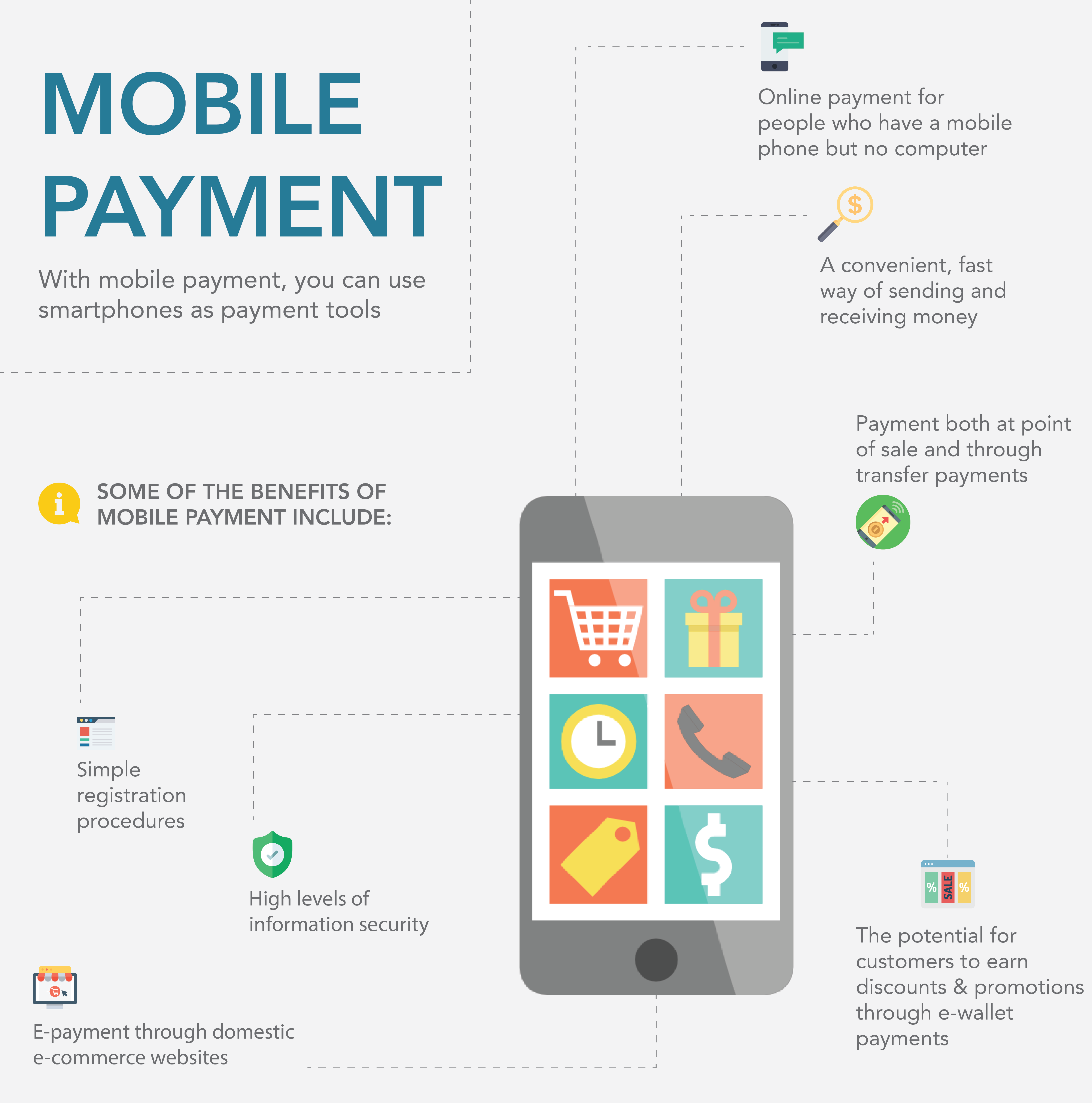

Mobile payment applications

Mobile payment applications available in Indonesia

According to an Asian Nikkei Review article, the most popular mobile payment applications in Indonesia are:

Digital payment and e-wallet applications

These are three of the most popular mobile wallet sites in Indonesia:

These are the top six e-commerce sites in Indonesia:

Personal Finance

Personal finance online tools and software are available to support individual and business financial management and transactions through banks. These tools also support users’ access to their financial information on all mobile devices, even if a computer is not available. These online tools can make money management much easier and quicker for a business owner.

Personal finance tools available in Indonesia

Traditional Financial Funding

Access to financing is always important when starting a new business. To access funding, businesses may seek out venture capital funds, a financial lease company, or government innovation and technology support organizations.

Access to financing is always important when starting a new business. To access funding, businesses may seek out venture capital funds, a financial lease company, or government innovation and technology support organizations.

Venture Capital Funds in Indonesia

- Kejora Ventures

- Convergence Ventures

- GDP Venture

- East Ventures

- Sinar Mas Digital Ventures (SMDV)

- 500 Startups

- Venturra Capital

- Ideosource

According to Techbullion, these are some of the most popular financial service companies in Indonesia:

- ABM Investama

- ACE Hardware Indonesia

- Bakrie & Brothers

- Bank Artos Indonesia

- Buana Finance

- Asuransi Jasindo

- Central Asia Insurance

- Link

- Prima

- ATM Bersama

- UangTeman

Angel Investing

The Financial Times defines angel investment as “the earliest equity investments made in startup companies. Angel investors are almost always wealthy individuals and commonly band together in investor networks. Often these networks are based on regional, industry, or academic affiliation.”

ANGIN (Angel Investment Network Indonesia) aims to support Indonesia’s economic development by connecting investors with entrepreneurs and by introducing best practices to early stage investment in Indonesia.

Start-up founders currently fundraising can apply for funding through ANGIN’s network here.

Microfinancing

As described in its website, MICRA (Microfinance Innovation Center for Resources and Alternatives) is an Indonesian foundation focused on development of the microfinance sector. MICRA provides technical input and support to industry stakeholders.