Financing

How can technology and innovation help you with financing your business? Technology and innovation in finance can help you access capital more easily, and access finance management software. This software supports businesses to effectively manage their assets, control their cash flow, and maximize the productivity of their projects.

Financial Technology (Fintech)

Fintech is a dynamic sector at the intersection of finance services and technology. In fintech, financial companies provide capital services and products for start-ups and businesses entering new markets. Fintech is changing the traditional value chain in the finance sector.

Fintech is a dynamic sector at the intersection of finance services and technology. In fintech, financial companies provide capital services and products for start-ups and businesses entering new markets. Fintech is changing the traditional value chain in the finance sector.

Fintech: Non-Traditional Funding

Crowdfunding

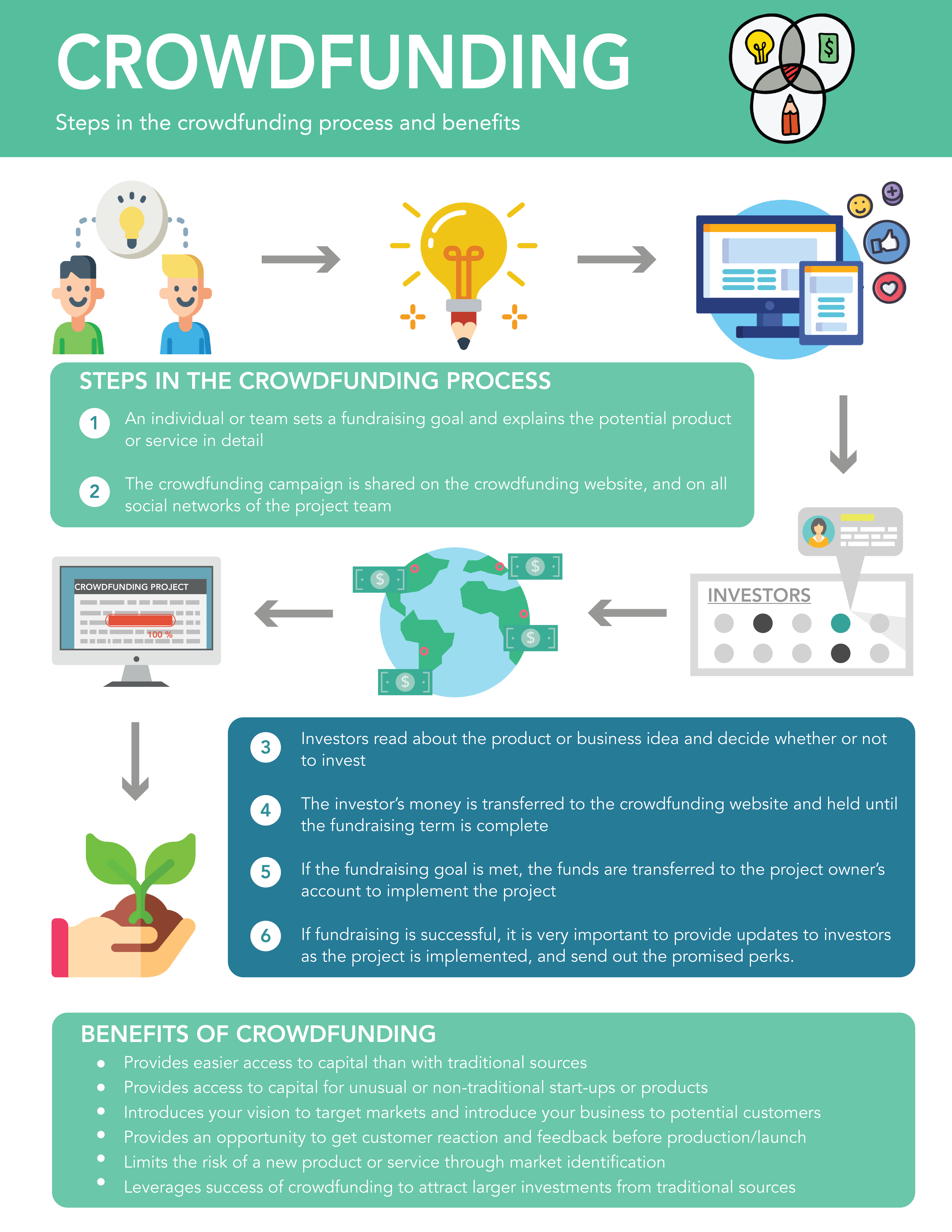

Crowdfunding takes advantage of the larger audience of the web to raise capital for projects that would otherwise have difficulty obtaining funding from traditional banks. Crowdfunding websites make it easy for an average person to invest a small amount in an interesting project. If the business can attract a large number of small investors, it can still raise a significant amount of capital.

Crowdfunding is often used by individual start-ups and for new projects by small businesses. Entrepreneurs use crowdfunding when they are raising capital and as an initial launch funding before looking for larger loans and investors. Attracting a large crowdfunding audience can show that a market exists for a new product, and can refine an idea with market feedback before investing money in production.

Benefits of crowdfunding & Steps in the crowdfunding process

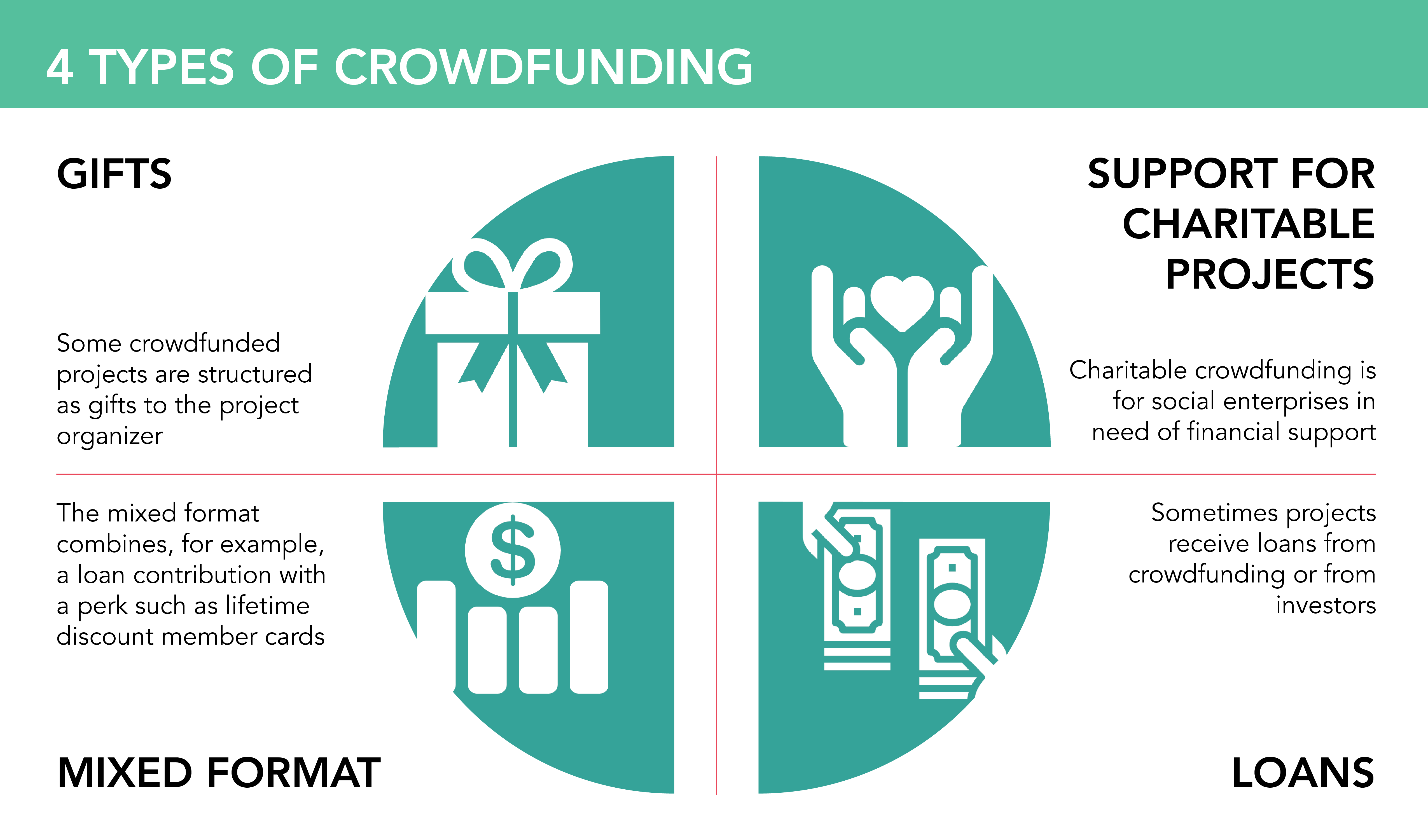

Types of crowdfunding

Crowdfunding websites – International

Crowdfunding websites – the Philippines

Local MSME entrepreneurs need to be aware of crowdfunding regulations in the Philippines.

- Cropital

- FarmOn

- Gava

- Spark Project

- Upbuilds

- PhilAmTHropy (PATH) is a Filipino crowd funding website for and by Filipinos

- Artiste Connect is a Filipino crowd-funding site for creative entrepreneurs and artists

- GetStarted.Ph is the crowd funding community in the Philippines

- Homegrown.ph is a Filipino crowd funding community

- Start Some Good is an Australia based global crowdfunding platform for social impact projects

Crowdfunding Case Study:

A professor from De La Salle University in Manila has published a multi-case study of crowdfunding Philippines-based projects.

Dreamlords Digital, a development studio with teams in Manila and Las Vegas, got its game Graywalkers: Purgatory funded on Kickstarter.

Peer-to-peer lending

Peer-to-peer lending websites create successful direct connections between people who have money to lend and people in need of loans. These platforms help businesses connect with funding without any intermediary lending agencies.

Steps in peer-to-peer lending

- A business owner or entrepreneur registers an account on a peer-to-peer lending website

- The business owner creates an application, including a time frame and amount for the loan, and a summary of the skills and expertise in the team

- A financial expert from the website appraises the application

- If the application is accepted, the business owner agrees to the terms and conditions of the investment and the interest rate

- The application may be officially accepted with the requested loan amount, but often there will be some conditions for minimum funds raised

- The request for investment is put up on the website, where investors can browse and select from approved investment opportunities

- Website staff handle legal procedures related to the loan agreement for all partners

- The peer-to-peer lending website distributes the loan funds to the business owner, and sets up accounts for the business owner to automatically make monthly payments on the loan

Peer-to-peer lending websites

Fintech: Managing Your Money

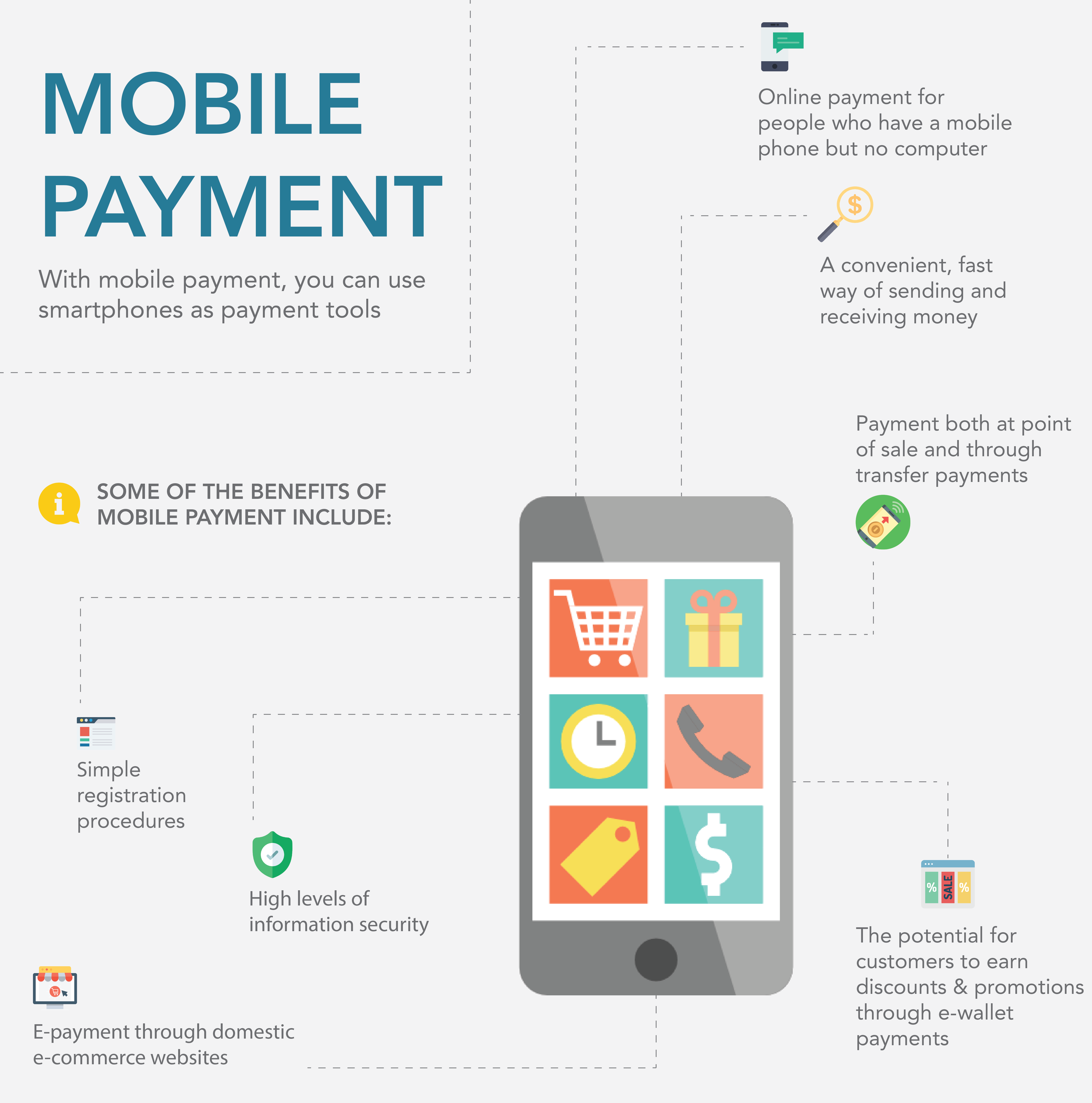

Mobile Payment Applications

Mobile payment applications available in the Philippines:

Digital payment and e-wallet applications:

- AUB PayMate: WeChat Pay and AliPay

- CoinsMobile Payments

- Globe GCash

- PayMaya Philippines

- Dragon Pay

- 7-Connect

- GrabPay Credits

- PayPal Debit

Personal finance

Personal finance online tools and software are available to support individual and business financial management and transactions through banks. These tools also support users’ access to their financial information on all mobile devices, even if a computer is not available. These online tools can make money management much easier and quicker for a business owner.

Personal finance tools available in the Philippines:

Traditional Financial Funding

Access to financing is always important when starting a new business. To access funding, businesses may seek out venture capital funds, a financial lease company, or government innovation and technology support organizations.

Access to financing is always important when starting a new business. To access funding, businesses may seek out venture capital funds, a financial lease company, or government innovation and technology support organizations.

Grants and Funds (source)

- Manila-based Asian Development Bank (ADB) is offering an initial $3.6-million grant for the development of inclusive business in the Philippines and the rest of Asia

- The Asian Information Society Innovations Fund offers grants in ICT related innovations

Venture Capital Funds in the Philippines

- IMJ Investment Partners started investing in start-ups in Japan and Silicon Valley since January 2012

- Tallwood Venture capital seeks to invest in talented entrepreneurs and potent ideas

- First Asia Venture Capital Inc. (First Asia) is a venture capital company involved in a number of Philippine-based business

- Investment & Capital Corporation of the Philippines (ICCP) is a leading independent investment house that offers a wide array of financial services, enabling access to both the Debt Capital Market and the Equity Capital Market

- CLFG CAPITAL CORP. (CLFG CAP), a member of the CL FOLLOSCO GROUP, is a private investment firm based in the Philippines. They seek to partner with small and medium size companies with sound business models and strong potential for earnings growth

- ABCapitalOnline.com, Inc. provides investment banking and corporate finance services to corporate fund users and investors. Its services include venture capital fund management

- Al-Amanah Islamic Investment Bank of the Philippines (AAIIBP) is authorized to provide Islamic banking, financing and investment services pursuant to R.A. 6848. In 2008, AAIIBP became a subsidiary of the Development Bank of the Philippines

- AMA Rural Bank of Mandaluyong, Inc. offers, among other services, SME loans geared towards business enterprises engaged in industry, agri-business and/or services requiring cash funding for business-related purposes

- Mabuhay Capital Corporation, Inc. provides financial advisory services and capital raising solutions to clients dealing with mergers and acquisitions (M&A), restructurings and, other strategic issues

Angel Investments

- Idea Space Foundation’s program is intended to provide start-ups the support needed at critical phases when ideas are being turned into actual commercial products

- 500.co is a Seed funding body that funds companies all around the world, including the Philippines

- Launch Garage is a Filipino accelerating and funding program

- Philippines Angel Investors is a list of private angel investors active in the Philippines

- Manila Angels is a Manila (Philippines) based private network of Angel investors

- Narra Venture Capital invests in private high-technology companies

Finance Companies in the Philippines

Loans and Microfinance (source)

Loans are a common way of financing companies: you borrow from the investors/lenders an agreed amount (the principal) and reply the principal and interest to them after a specified period of time. Microfinance loans typically target small business owners.

- The Fico Bank offers the Kabayan microloan for entrepreneurs

- The Bangko Kabayan Inc. offers both microfinance loans and an SME loan

- The Cantilan Bank Inc. offers microfinance loans a business finance loan

- The 1st Valley Bank offers microfinance loans and Financial Assistance to Micro-Entrepreneurs (FAME)

- The Card Bank offers both microfinance loans and SME loans

- The Financial Executive Institute of the Philippines is offering a FINEX SME Plus Loan Portal where SMEs can register their loan requirements and hopefully be financed by lenders who view the requests

- Business Diary published a list of funding sources for businesses in the Philippines

- Oikocredit provides loans, credit lines and equity to 71 countries since 1975