Aiding MSMEs’ Digital Transformation

Even prior to the pandemic, MSMEs have been transitioning from analogue to digital business models, utilizing digital business strategies, practices and online platforms. Vital components of “going digital” include a strong online presence fostered through social media and company websites, an e-commerce platform to facilitate the buying and selling of goods and services, and online systems to conduct business practices such as human resources. The COVID-19 crisis has now made digital business strategies a requirement for MSMEs’ continued survival.

In considering avenues for digital upskilling, it is vital that access to internet, devices, and technology and software are taken into account. Disparities in access to digital infrastructure will greatly impact MSMEs’ capacity to expand into online digital markets, and their potential to succeed in them.

Guiding questions:

-

How can governments support MSMEs’ digital transformation?

-

What do MSMEs need to digitalize, and what are the benefits of digitalization for them?

Context

1. Internet access

1. Internet access

Internet access, and more broadly information and communications technology (ICT) infrastructure, is a crucial building block that enables MSME capacity and further unlocks their potential. Reliable ICT infrastructure is a vital foundation for MSME innovation and market expansion, and stable internet access can be a determining factor in MSMEs’ ability to expand into the digital economy.

ICT infrastructure refers to the equipment, software and systems that are required to facilitate digital business processes. This can include the following:

-

Internet access

-

Hardware, including personal computers

-

Workplace software

-

E-commerce platforms

A strong ICT infrastructure is critical to the successful digital transformation of MSMEs, and entrepreneurs’ resulting participation in the digital economy. The Partnership recommends that APEC economies invest in ICT infrastructure to support MSMEs to reach online resources and digital business tools.

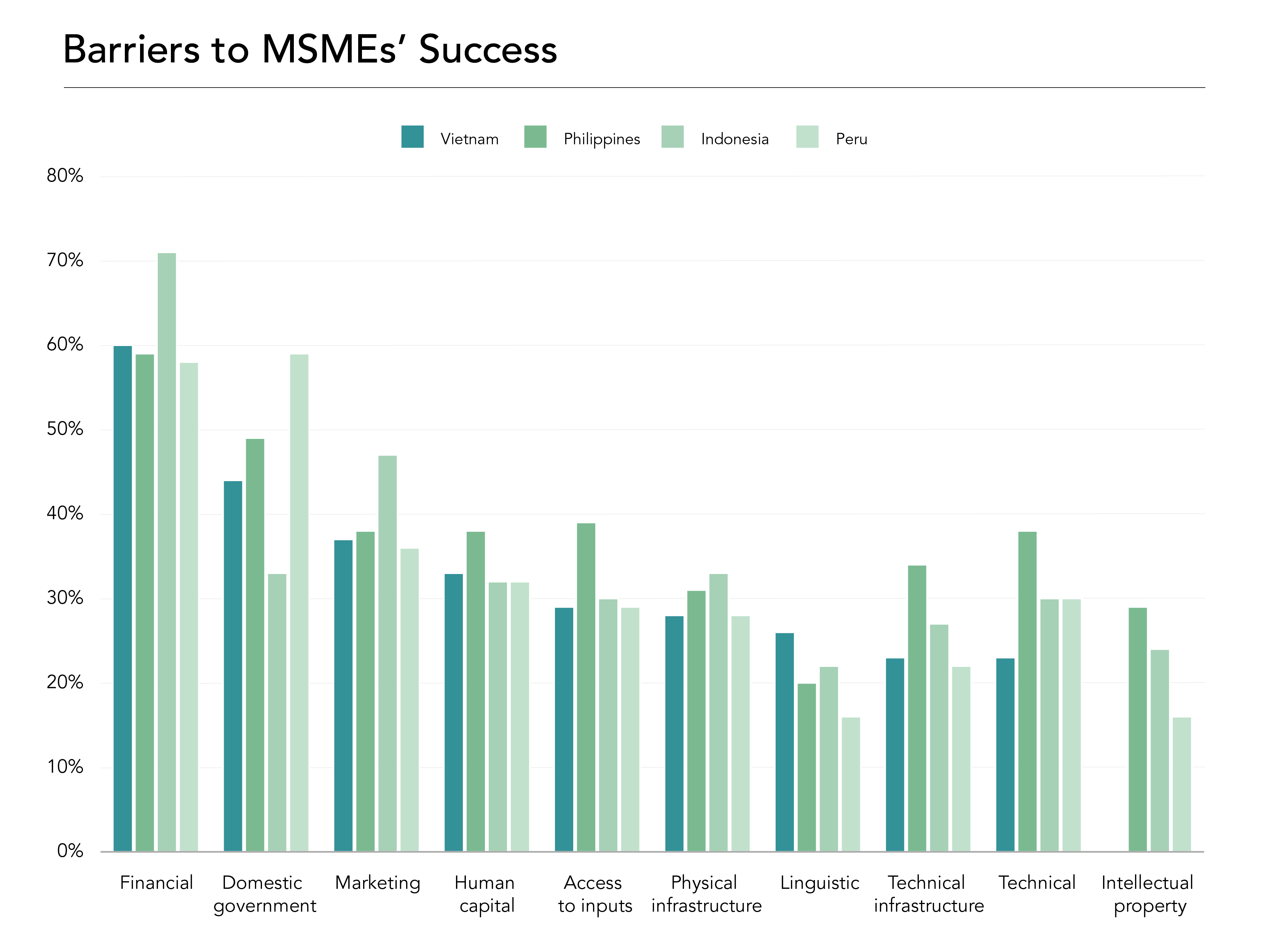

The Partnership’s national survey data shows that at least a fifth of surveyed entrepreneurs in each economy had an issue with ICT and technical infrastructure. The highest number is seen in the Philippines, where 34 per cent of surveyed Filipino entrepreneurs said that internet connection is one of the problems for their business. Meanwhile, this proportion was 27 per cent in Indonesia, 23 per cent in Vietnam, and 22 per cent in Peru.

This data indicates that a sizeable number of entrepreneurs in each APEC economy experiences an issue with adequate internet access and ICT infrastructure. It is vital that policymakers and business actors alike ensure that no entrepreneurs and MSMEs are left behind in terms of internet access.

However, beyond technical infrastructure, digital tools and knowledge of these resources are important for MSMEs to utilize in order to successfully navigate the digital economy.

2. Targeting existing social media and website usage

2. Targeting existing social media and website usage

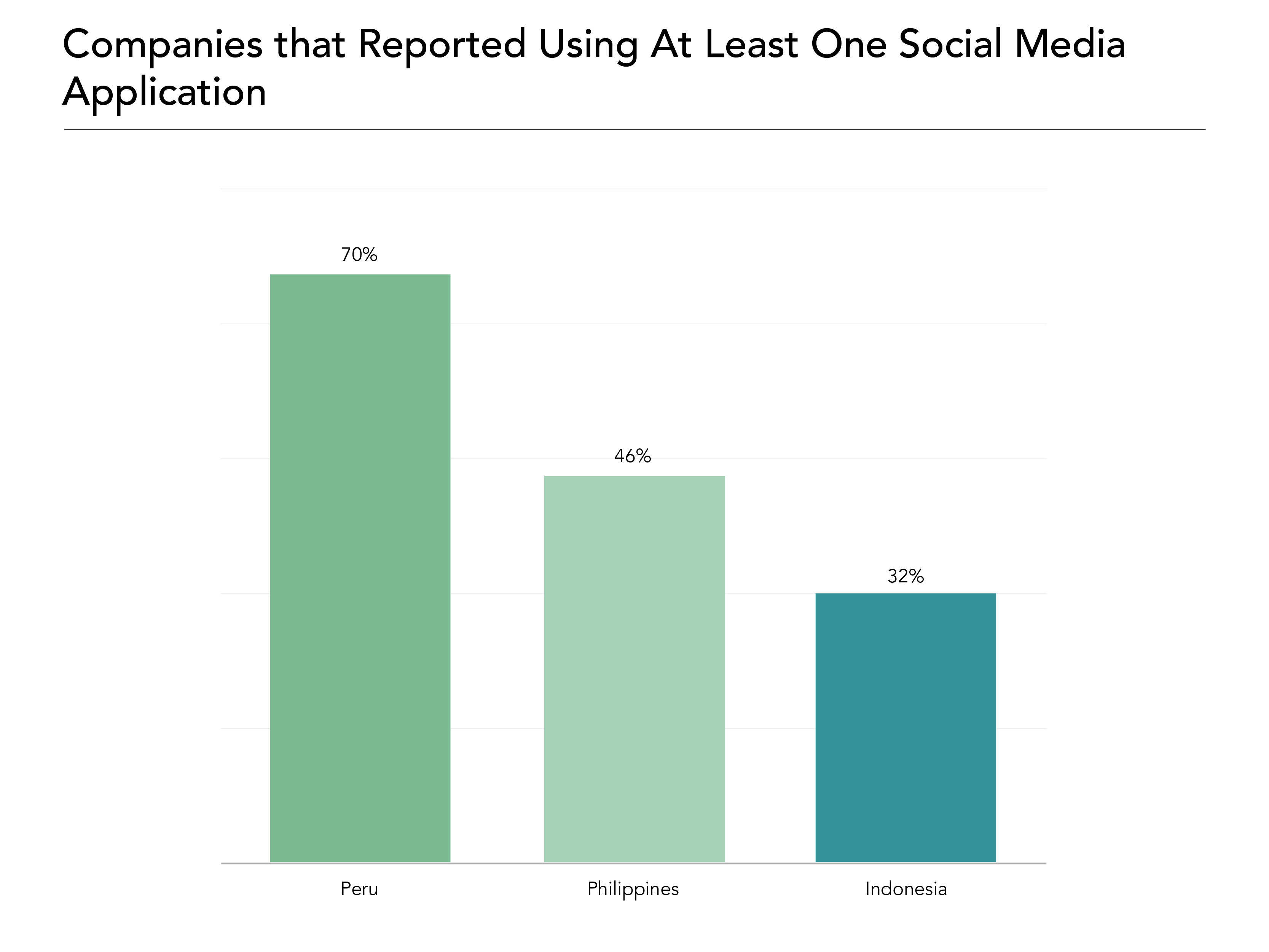

Data from the Partnership’s national survey gives crucial insight into the existing social media and website usage patterns amongst MSMEs and entrepreneurs. It is vital that governments and other relevant bodies utilize similar data to inform digitalization policies and programs.

According to the Partnership’s national survey data, the highest rate of social media usage was in Peru, where almost three quarters of surveyed entrepreneurs said they used at least one social media application for their MSME.

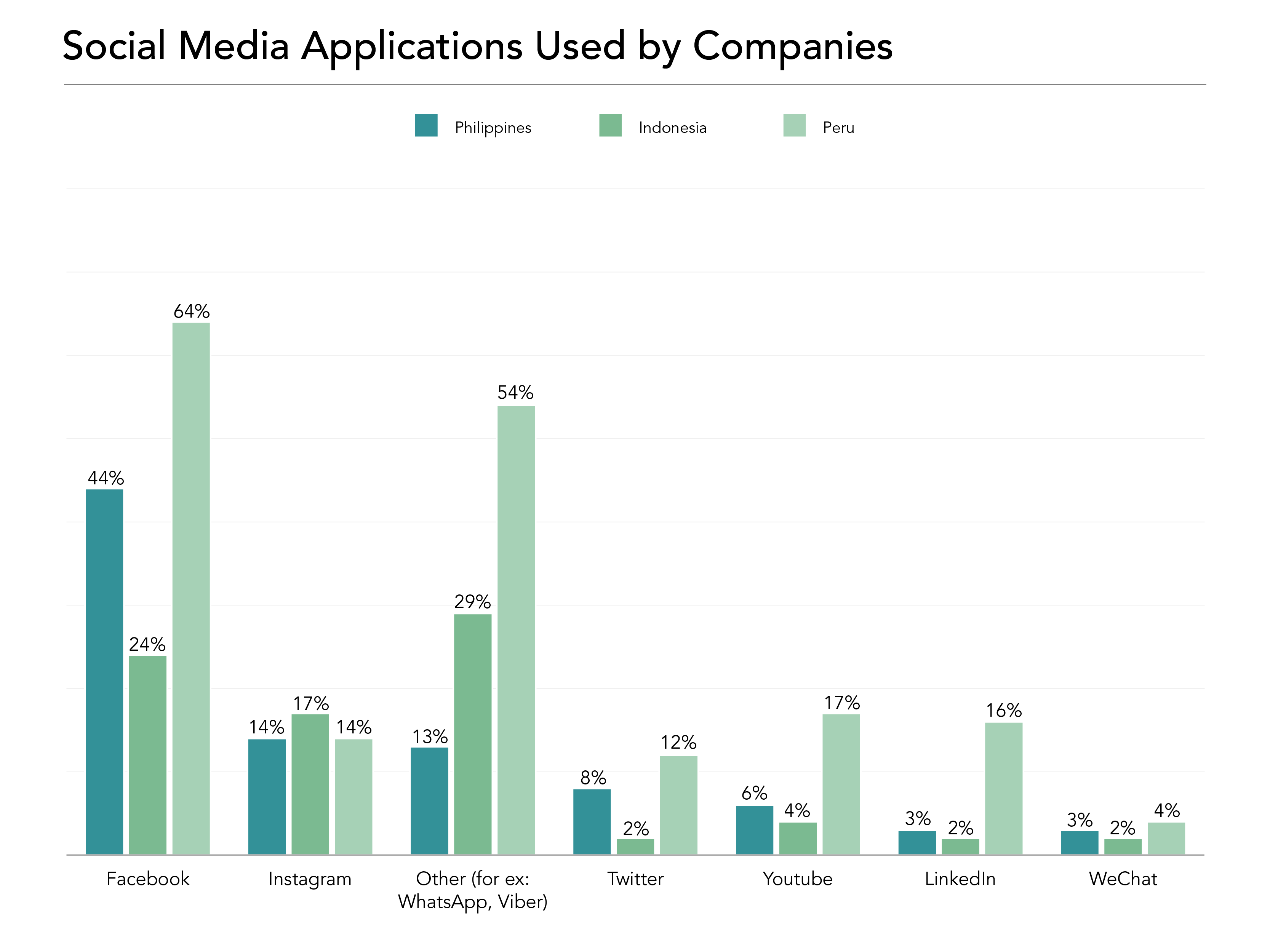

Facebook is the most popular social media platform used by surveyed MSMEs in Peru, the Philippines, and Vietnam. Meanwhile, in Indonesia, WhatsApp is the favoured platform among MSMEs (included in the “other” category in the graph below).

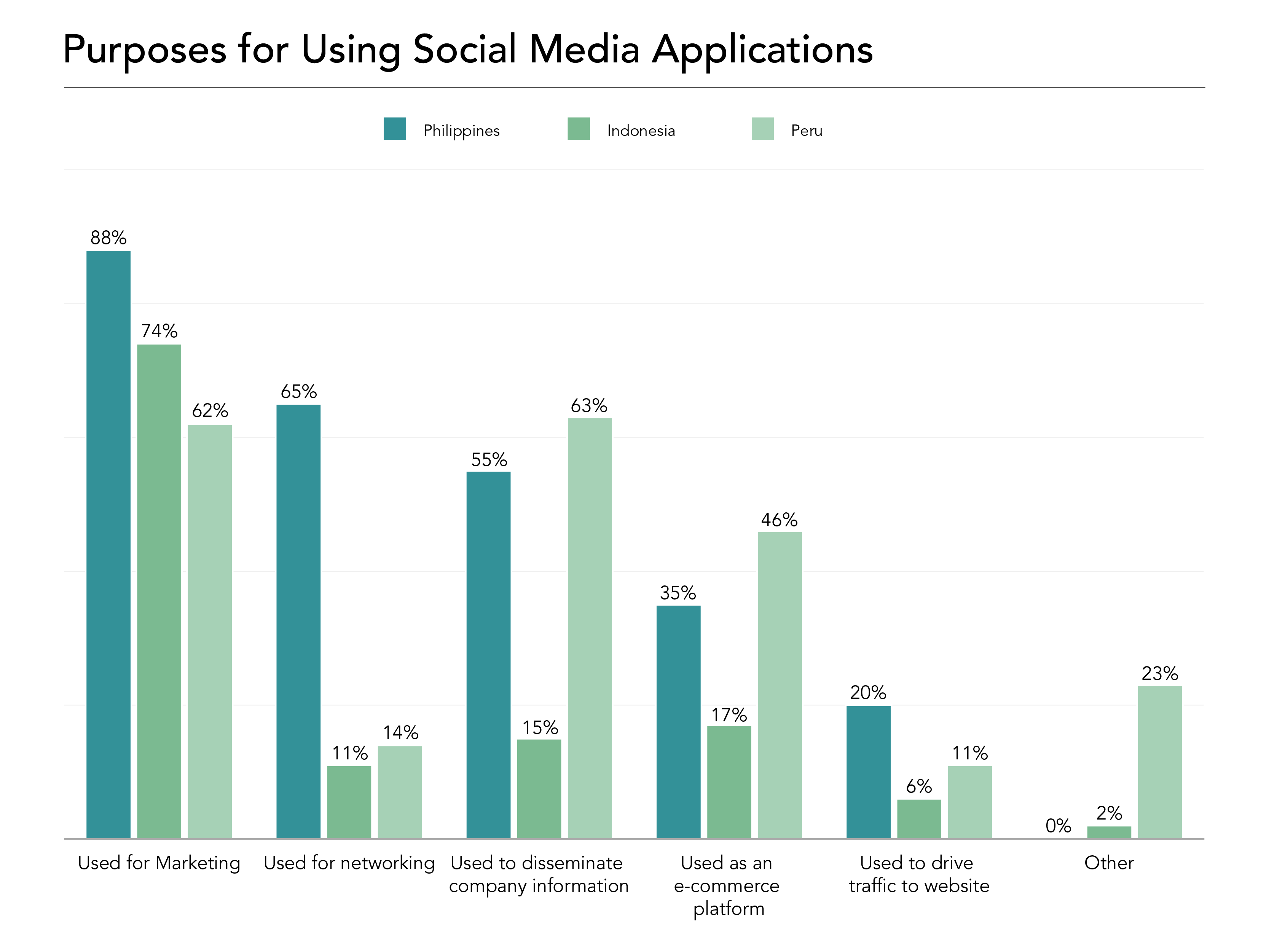

The majority of entrepreneurs said they used social media for marketing. Some other widely mentioned reasons include networking, disseminating company information, and using social media for e-commerce.

Only a minority of users said they use social media platforms for e-commerce. This finding poses a concern for implementing e-commerce and other digital platforms during the COVID-19 pandemic. Interestingly, in Peru, where this number is slightly higher (46 per cent), e-commerce is mostly conducted on Facebook.

The Partnership recommends that relevant government and business actors provide upskilling opportunities in e-commerce and social media, as well as promote the benefits of conducting business online.

Websites are another important component of businesses’ digital strategy, which can provide a central location of information about an enterprise. In contrast to social media, the usage of websites among survey respondents is very low. While these results may have changed since the time of each national survey, this finding demonstrates that MSMEs largely do not utilize websites.

For the few respondents who do utilize websites, the most widely mentioned reason for having one is to provide the company’s contact information for clients. This finding indicates that MSMEs can benefit from upskilling or other opportunities that teach them how to effectively utilize both websites and social media for e-commerce, among other business areas.

Our research highlights that entrepreneurs could begin with simple, less expensive platforms like online sales websites, and then adopt more complex platforms like their own website as their capacity increases.

Moreover, it is important to note that MSMEs have varying capacity to use social media for marketing and other purposes. While social media accounts are free, having online advertisements can quickly become expensive for small businesses, particularly those that are newly established and are in niche markets. For example, online advertisements could cost $5 a day, and unless a business’ product or service is common, it would be difficult to effectively compete against larger companies with a similar product or service.

MSMEs will need to learn and adapt to conducting their traditional businesses in virtual spaces. Our data demonstrates that social media and website usage in MSMEs’ digital strategies can be optimized for the digital ‘new normal’ mode of business during the pandemic. It is critical that entrepreneurs and MSMEs receive support and training according to their needs to build their capacity in digital business strategies.

One effective way to provide resources and upskilling opportunities for MSMEs in digital business tools is through membership in business associations. Such associations can provide information and support to help MSMEs engage in online sales and adopt digital business strategies that are feasible for them, given their target market, product or service, current consumer base and revenue level.

For example, business associations could provide information on online sales platforms where newer MSMEs can begin marketing and selling their products online, and training for established MSMEs on online marketing and running an online sales platform. Moreover, if individual websites are too expensive for MSMEs to have, business organizations could pool similar MSMEs together to establish a common online sales platform.

3. Digital upskilling opportunities

3. Digital upskilling opportunities

In addition to questions on social media and website usage, our national surveys also collected data on the usage of online applications for business training and upskilling. Given the restrictions on in-person activities, online courses can be effectively utilized to provide resources and education for MSMEs in various areas like financing. Additionally, the rollout of online courses could make resources and support services more accessible to MSMEs, depending on whether entrepreneurs have adequate internet access and ICT infrastructure.

Similar to data on social media and website usage, this type of information would help inform government and business actors on existing usage of digital upskilling initiatives, and thus how to target programs for MSME digitalization.

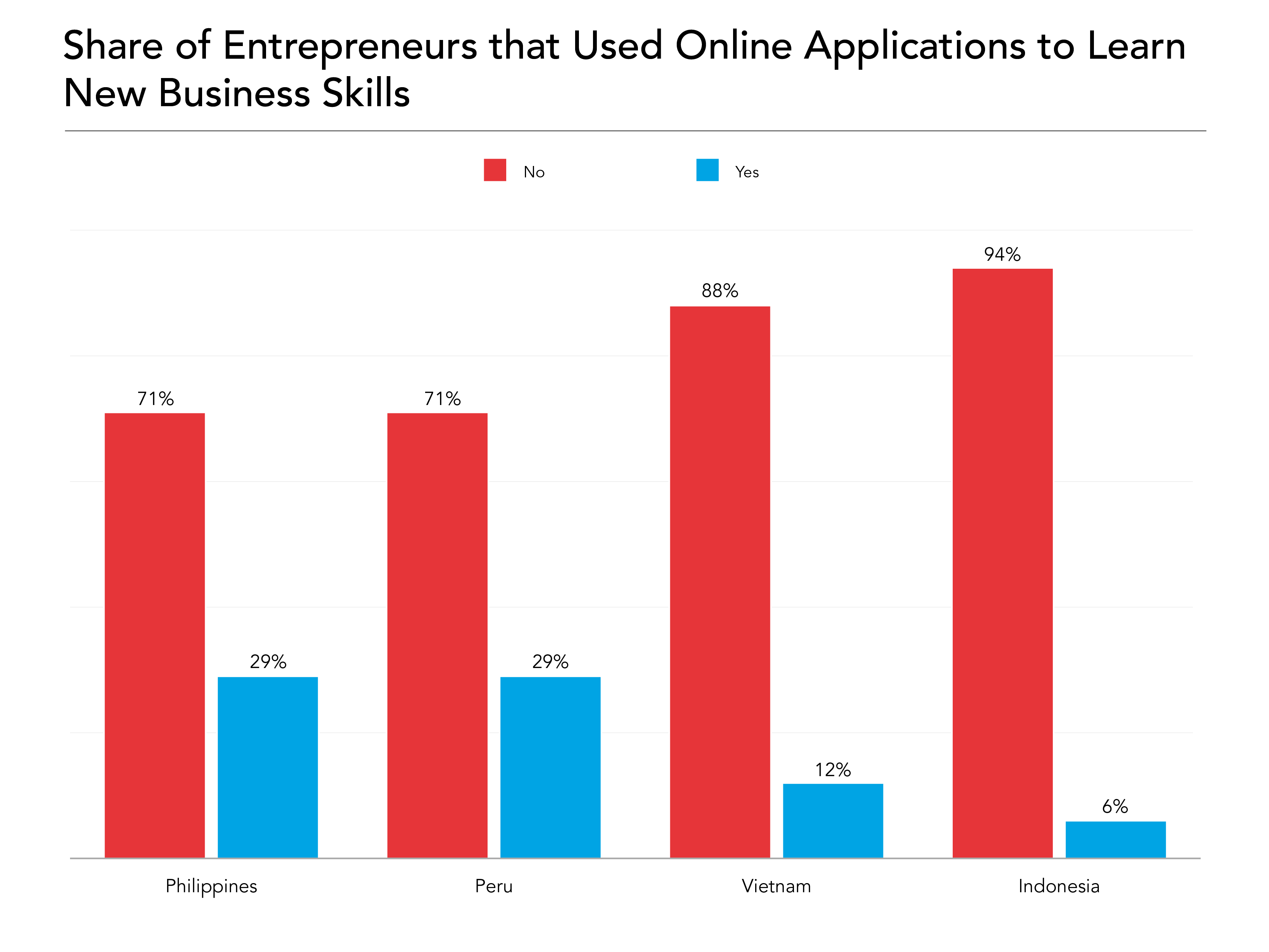

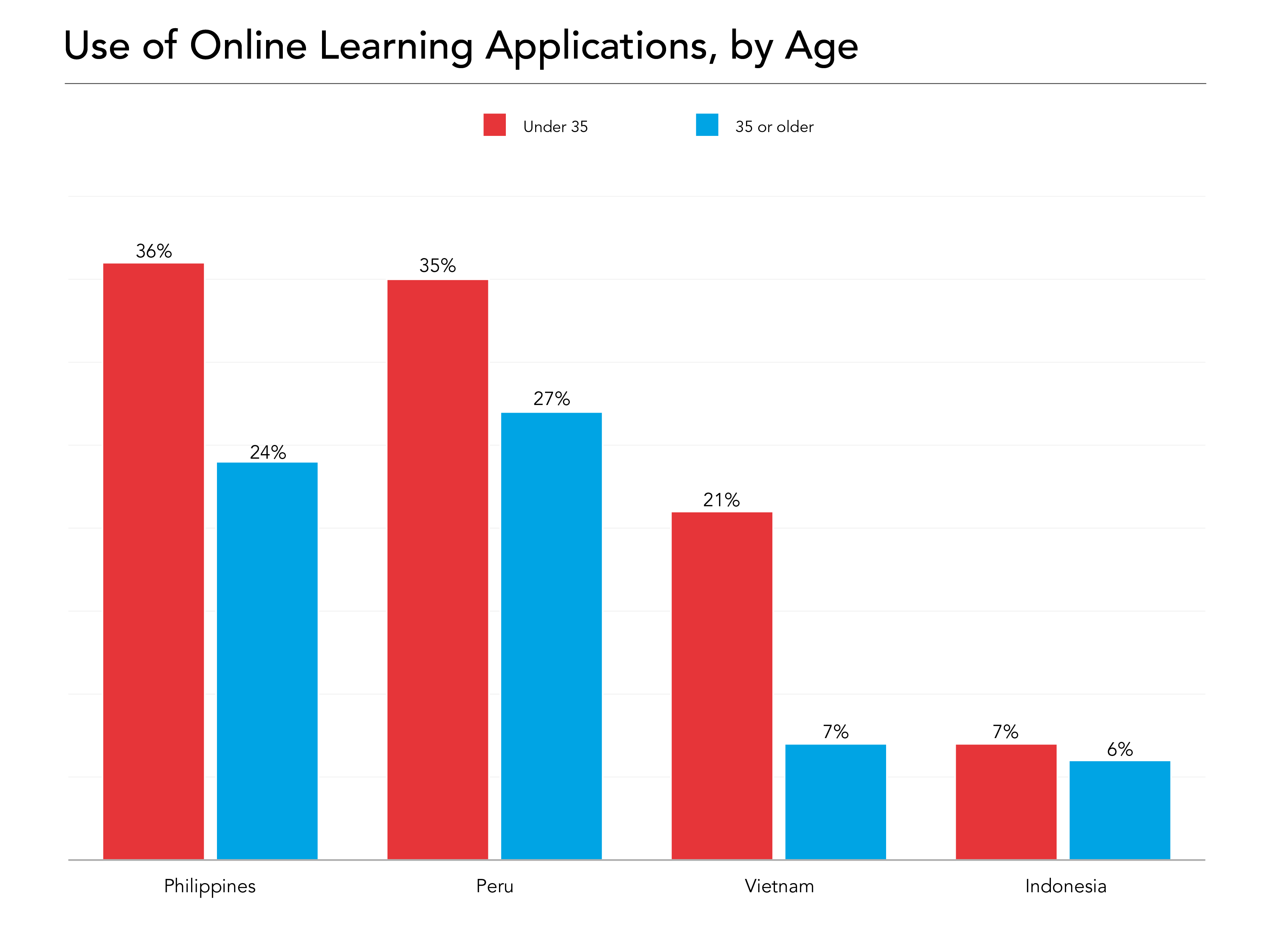

There is a consistently low level of usage of online upskilling and learning applications among surveyed entrepreneurs. Notably, this number is slightly higher in the Philippines and Peru.

The age of entrepreneurs appears to be a major factor that determines patterns of online applications usage. Our national survey data shows that a consistently higher number of respondents under the age of 35 years old said that they used these applications, in comparison to older respondents. This finding demonstrates that initiatives to increase access to online courses must also consider the technical knowledge that entrepreneurs have and need to access online platforms.

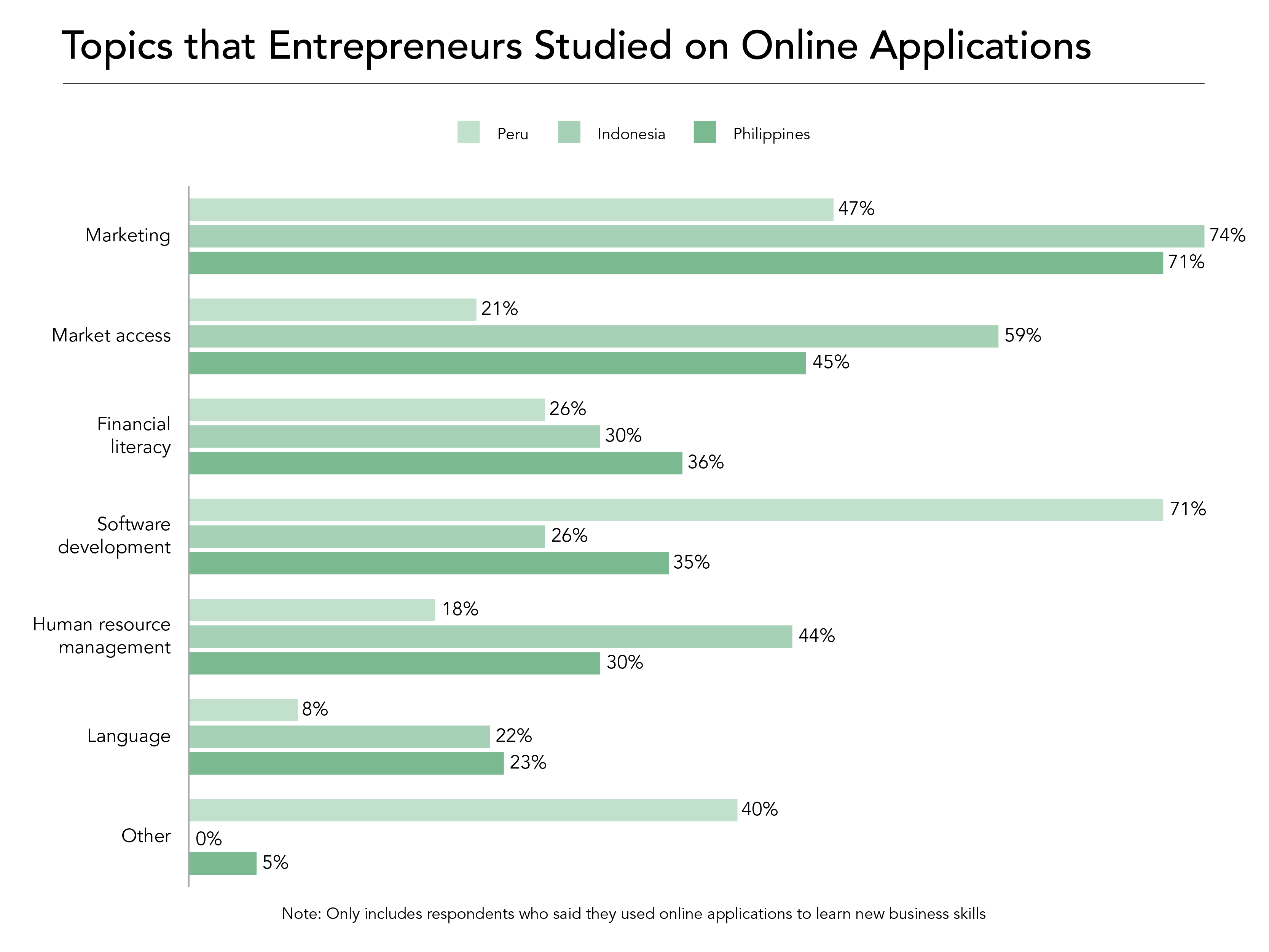

Considering what topics were explored on online learning applications, the majority of respondents in Indonesia and the Philippines said they used these applications to learn about marketing. In Peru, the majority of respondents said that they used these platforms to learn about software development.

Overall, while only a minority of survey respondents have used online learning applications, the majority of users said that these had a positive impact on their business practices. This finding demonstrates that MSMEs are likely to reap benefits from online courses, given that they have the financial and digital resources to access such opportunities.

For example, our research in Peru argues that entrepreneurs can be further encouraged to acquire international experience through online courses that introduce them to market access expansion and exporting requirements.

The Partnership recommends that APEC governments and business communities make resources in various areas of MSME capacity building more accessible via online courses, and raising entrepreneurs’ awareness of these free or low-cost resources.

-

New challenges with MSME digitalization

In addition, adopting and using new digital approaches not only requires digital upskilling of skills and abilities, but also understanding potential risks. The APEC Policy Support Unit and other organizations have outlined several potential challenge areas around digitalization including:

-

New rules and regulations that will emerge around data and privacy.

-

Risks of cyberattacks and cybersecurity breaches of personal information.

-

Misinformation and digital fraud, especially around e-commerce.

-

Asymmetry of digital platforms and monopolies/control by larger digital platforms.

-

Risk of further digital divides (e.g. urban vs. rural areas) due to ICT infrastructure disparities.

An important consideration in digital upskilling is the question of service providers, and which actors are responsible for MSMEs’ digital training. Our research has especially highlighted the role of governments in ensuring the availability and accessibility of online resources and services for entrepreneurs through existing and well-known platforms.

It is crucial that governments, in addition to these efforts, also partner with local actors, including business associations, educational institutions, and social media companies to increase awareness of digital upskilling opportunities.

In particular, governments must ensure there are sufficient opportunities to gain digital financial literacy. As companies transition to digital payment systems, entrepreneurs and MSMEs should ideally be provided with training on these new systems. Entrepreneurs in remote and rural areas especially may not have sufficient access to these online systems, or may favour cash-based payment. Certain groups or communities may have cultural reasons for keeping cash as opposed to digital currency. Government and business actors must also take note of communities that may not have easily accessible financial centres or ATMs.

Policy recommendations

-

ICT infrastructure: Build and maintain a robust internet infrastructure in a given economy, to ensure that all entrepreneurs, regardless of location (e.g., urban vs rural-based businesses) have a consistent and financially accessible internet connection.

-

Data on usage of digital tools: Collect data on MSMEs’ usage of social media, websites, and other digital tools, toward informing support programs and policies for MSME digitalization, and target such initiatives to their needs.

-

Mentorship and upskilling opportunities: Encourage information sharing and partnerships between government and large corporations to provide knowledge and training to MSMEs on creating a digital strategy, and how various online platforms can be used to entrepreneurs’ advantage.

-

Upgrading and updating regulatory frameworks: Encourage further regulation around privacy and data, and further training for MSMEs to protect themselves from potential security breaches and cybersecurity attacks. Update legislation around information communication technology. Without a clear legal framework, this can create a hinderance for capital investment in wireless technology.

Relevant Policies

PEC SME Financing and Digital Transformation in a Globalized Economy: Statement issued after the 25th APEC SME Ministerial Meeting in September 2019, in which representatives encourage initiatives that foster innovation, promote digitalization, and improve financing and internationalization of SMEs.

OECD Digital for SMEs Global Initiative: Initiative aiming to promote knowledge sharing and learning on how to enable SMEs to make the most of the digital shift.

ASEAN Work Programme on E-commerce and ASEAN Agreement on E-commerce: Agreement which aims to facilitate cross-border e-commerce transactions in the region with provisions on cybersecurity, data localization and data flows, online consumer and personal data protection, and dispute resolution mechanisms.

The Digital Transformation of SMEs: A 2021 report published by the OECD on trends in SME digital uptake, new challenges that have emerged with digitalization, and the opportunities, risks and barriers in enterprises’ adoption of digital technologies.

Study on MSMEs Participation in the Digital Economy in ASEAN: A 2019 research study conducted by ASEAN on the ongoing progress in MSMEs’ adoption of digital technology and tools, and how entrepreneurs have incorporated digitalization in their business practises.