Securing MSMEs’ Access to Financing

![]() MSMEs require consistent access to sustainable financing to support their business operations and sales. Depending on their status (e.g., established or early-stage), industry, and business goal, MSMEs require various types of financing, such as public sector funding through grants or private investment. Funding providers or investors can include governments, banks, investor networks, and more.

MSMEs require consistent access to sustainable financing to support their business operations and sales. Depending on their status (e.g., established or early-stage), industry, and business goal, MSMEs require various types of financing, such as public sector funding through grants or private investment. Funding providers or investors can include governments, banks, investor networks, and more.

The issue of financing is persistently mentioned as a barrier to MSME success, according to the Partnership’s national survey data. In all four focus economies, financing is the most common barrier to MSMEs. The Partnership’s research argues that this discrepancy indicates respondents’ reliance on self-financing and family loans, and that obtaining formal financing is seen as a secondary option with high barriers.

Long-term goals of post-pandemic recovery policies should ensure that funding is sustainable so that MSMEs can thrive during and after the pandemic. Overall, financing is linked to many other issues in MSME capacity building, as without sufficient funds, MSMEs are unable to establish physical infrastructure, improve human capital, seek support services, and others.

Guiding questions:

-

How can governments support and secure MSMEs’ access to financing?

-

How can governments improve access to and awareness or knowledge of funding for MSMEs?

-

How do MSMEs perceive the availability, accessibility and benefits of funding?

Context

1. Why are MSMEs not seeking funding?

Existing research has shown that the majority of MSMEs rely on self-financing or informal loans from family or friends. The vast majority of these small businesses do not seek formal financing, due to various reasons including a lack of information, the early-stage status of the business, a lack of investor confidence in these enterprises, and obstructively high lending interest rates.

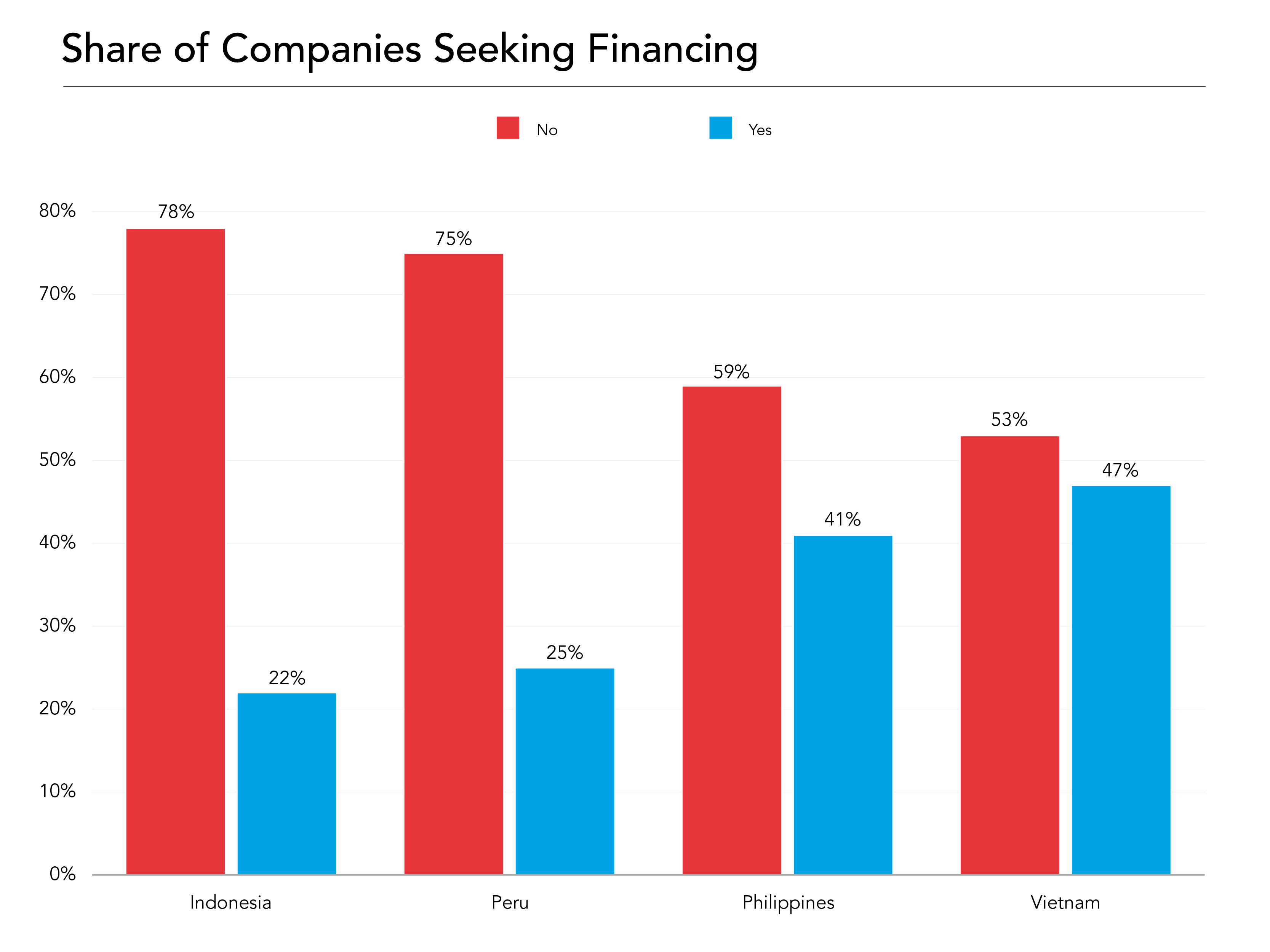

Our national survey data has provided evidence of this, and shows that the majority of respondents have said they were not seeking formal financing at the time of the survey. Less than half of respondents in each economy said they were seeking financing, with the lowest number seen in Indonesia.

However, at least a fifth of the survey population in each focus economy said that they were seeking financing, with the highest number seen in Vietnam. This indicates that a consistent minority of MSMEs are aware of financing options, and the benefits of accessing formal financing.

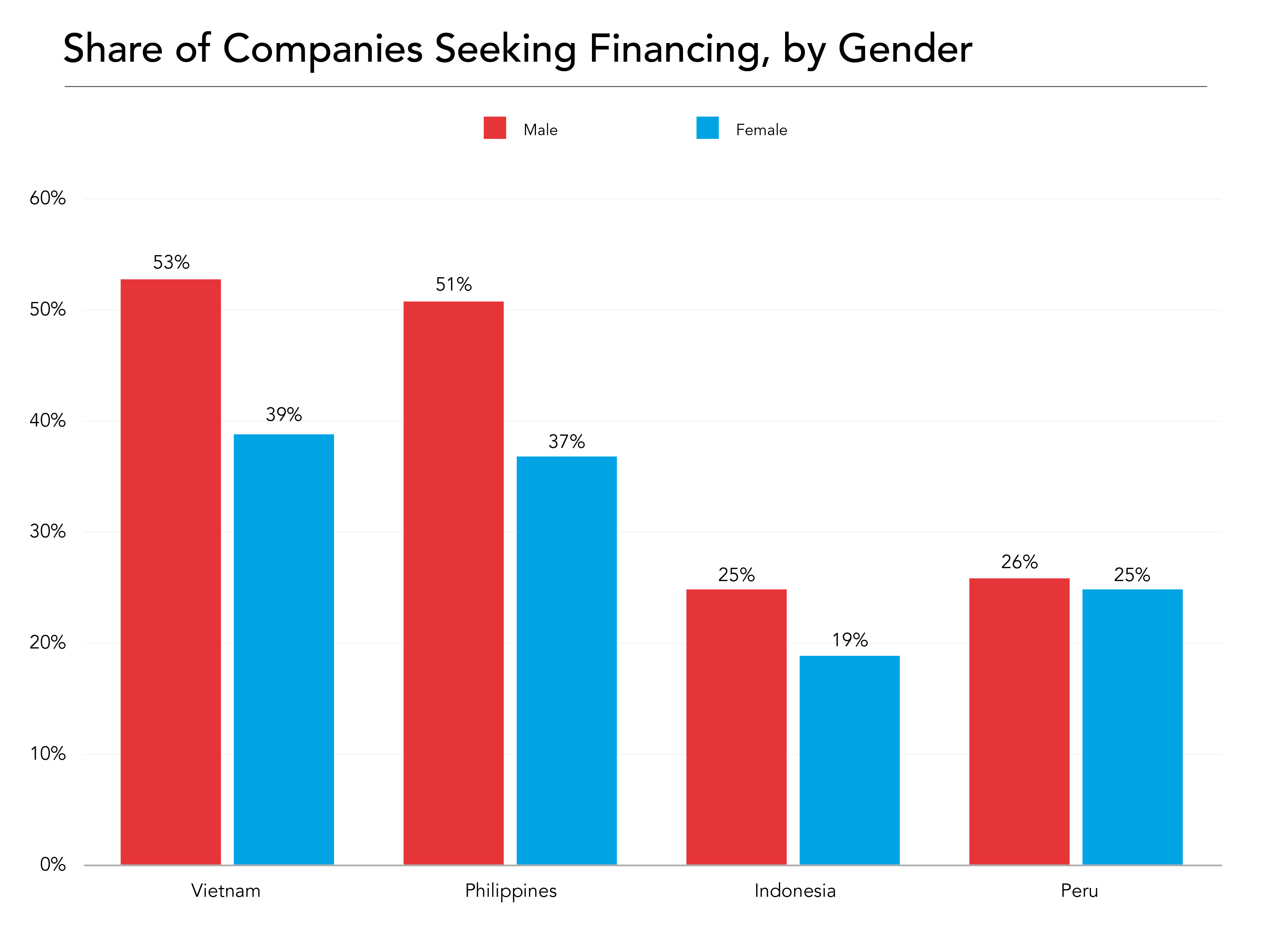

The gender of entrepreneurs appears to be significant factor in determining whether they seek financing. Across all the focus economies, more male respondents than female respondents said they were seeking financing. This trend can especially be seen in the national surveys in Vietnam and the Philippines. This finding indicates that male entrepreneurs may have more awareness of financing options, or more resources that enable them to seek other forms of funds. The Partnership recommends that APEC economies provide specific financial support for women-led MSMEs that is responsive to women entrepreneurs’ distinct needs.

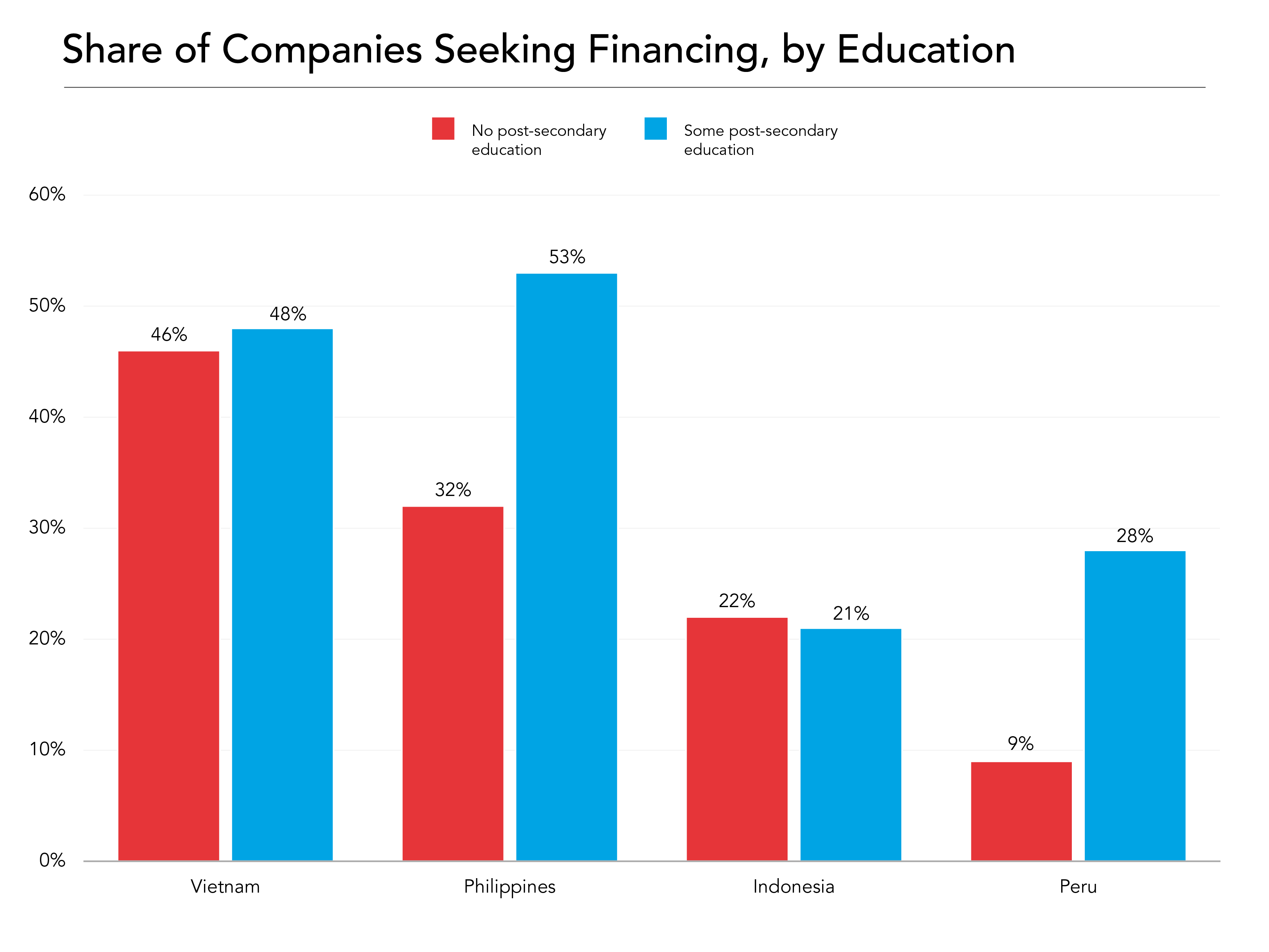

Education is yet another factor that appears to impact whether entrepreneurs are seeking financing. More respondents with post-secondary education said their enterprise was looking for funding than those without higher education. This gap is particularly visible in the Philippines and Peru. Similar to the role of gender, an entrepreneurs’ level of education may determine their awareness of financing options and the benefits of acquiring external funding. The Partnership recommends that information and resources on funding should be widely disseminated, through business associations and secondary educational institutions (e.g. high school entrepreneurship programs).

Overall, the Partnership recommends that policymakers collect disaggregated data and design policies on financial support that respond to the disparities highlighted in this data.

2. What types of funding do MSMEs need?

Overall, the Partnership’s research findings indicate that entrepreneurs need clear information and encouragement to access formal forms of financing through banks and other financial institutions.

The survey results indicate that male respondents and those with higher education may be more aware of the benefits of obtaining formal financing, despite the risk that comes with acquiring bank loans and other external funding. It is crucial that the benefits of formal financing are highlighted, to address entrepreneurs’ concerns and thereby give them the financial tools needed to build up their enterprise, particularly for women entrepreneurs and those without higher education.

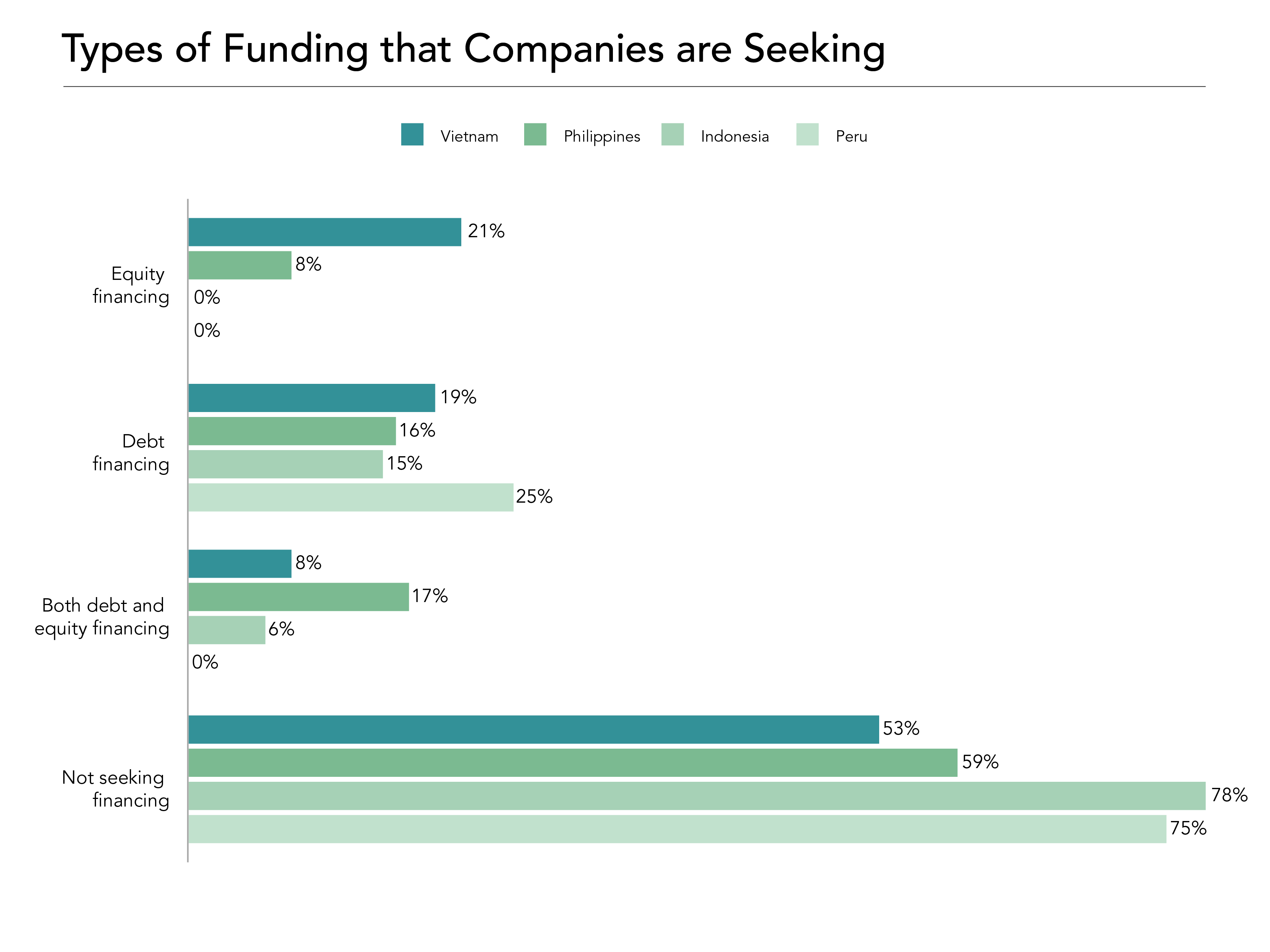

Considering the types of funding that survey respondents are seeking, there is a notable preference for debt financing, compared to other options asked in the national surveys. For respondents in Peru and Indonesia that indicated that they were seeking financing, most indicated that they were seeking debt financing. In contrast, more respondents in Viet Nam said they were seeking equity financing, while more respondents in the Philippines were seeking both debt and equity forms of financing.

In our national survey in Peru, survey respondents were also asked about other types of funding that could be applicable specifically for social enterprises. These options include capital financing, non-traditional funding resources such as angel investors or crowd funding, and impact investments. The most cited options among Peruvian respondents include debt financing (17 per cent of respondents), capital financing (15 per cent), and impact investments (four per cent). Still, the majority of the survey population (57 per cent) said they were not seeking financing.

In addition to demographic patterns in seeking financing, it is crucial to note that different types of MSMEs require targeted forms of funding. The type of funding that different enterprises require may best be determined by the following factors:

-

The age of the MSME (e.g.: early stage or established)

-

The business model, goals and mandate (e.g.: social enterprises’ specific social or environmental goal)

-

Entrepreneurs’ knowledge and networks

This is best demonstrated in our research on financing structures for Peruvian social enterprises. In contrast to other MSMEs, social enterprises must balance profit generation with their progress toward a social or environmental goal, and ensure success in both areas. The specific mission of social enterprises thus requires specific financial support.

Tailored funding for social enterprises shows that this specific type of MSME would benefit from blended finance structures and impact investment. These structures would supplement existing, though lacking, public financing mechanisms. such as government grants and incentives, with private sector funding. On the other hand, impact investment structures, where funding strategies are linked to a social or environmental impact, correspond very well to social enterprises’ goal of achieving their desired goals aside from profit generation.

Overall, funding structures do not exist in a vacuum. Instead, they must be complemented with government promotion and support for entrepreneurship and social enterprises, to maximize their impact and reach.

Policy Recommendations

-

More favourable financing terms: Facilitate more favourable terms for bank loans and other forms of formal financing, to accommodate the small resource base of many MSMEs that, as a result, may be risk averse to acquiring loans.

-

Fostering knowledge of financing options: Ensure that entrepreneurs have awareness and knowledge of the various types of financing available, as well as the benefits of these funding options. This includes sufficient promotion of financing options, including government grants and financial services, through partnerships with MSME business associations, banks and investors.

-

Collaboration with entrepreneurial partners: Work with banks, investors and MSME business associations to provide targeted forms of funding according to different MSMEs’ needs and capacity (e.g., blended financing structure with public and private funding).

Relevant Policies

APEC SME Financing and Digital Transformation in a Globalized Economy: Statement issued after the 25th APEC SME Ministerial Meeting in September 2019, in which representatives encourage initiatives that foster innovation, promote digitalization, and improve financing and internationalization of SMEs.

Asian Development Bank Small and Medium-Sized Enterprise Financing: Initiatives aiming to improve SMEs’ access to finance through credit institutions, leasing, credit guarantees, factoring, insurance companies, and capital markets.

OECD Financing SMEs and Entrepreneurs 2020: This report provides data from 48 countries on SME lending, alternative finance instruments and financing conditions, and information on policy initiatives to improve SME access to finance.

Asia Small and Medium-Sized Enterprise Monitor 2020 – Volume III: Thematic Chapter – Fintech Loans to Tricycle Drivers in the Philippines: A study from the Asian Development Bank that explores the impact of financial technology (fintech) on MSMEs through a case study example of fintech loans to tricycle drivers in the Philippines.

Handbook for MSME Access to Alternative Sources of Finance in ASEAN: A handbook published in 2017 that outlines alternative sources for MSME financing in ASEAN economies, including angel investors, venture capital, social impact investment, and equity crowdfunding.