Ensuring Access to MSME Support Services

In addition to financing and other business resources, MSMEs can benefit from support services that teach, empower and enable entrepreneurs to optimize their resources and operations. Support services can encompass business advisory services, mentorship programs, digital upskilling, and others. These services can be provided by large enterprises, MSME associations, governments and other entrepreneurial ecosystem actions.

This toolkit focuses on general business support services, as well as government support programs and policies, such as start-up grants, and incentives for exporting and research and development.

Guiding questions:

-

How can governments ensure access and timely availability of business support services for entrepreneurs, particularly women and youth?

-

Do MSMEs find these support services useful, and how could they be made better?

Context

1. Access to business support services

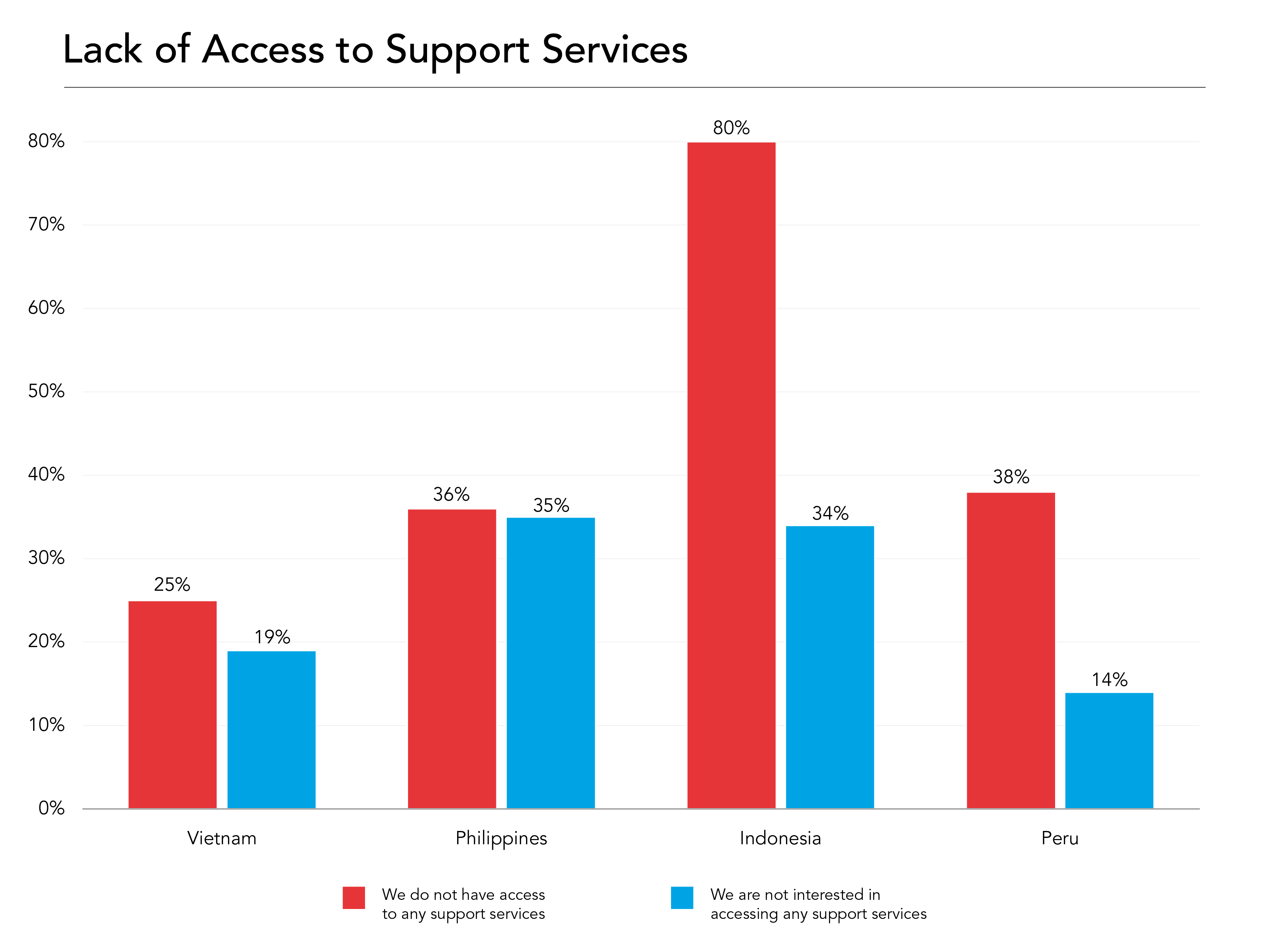

The effectiveness of currently available MSME support programs is undercut by the lack of awareness and accessibility to this support. Overall, our data shows that many MSMEs surveyed in each focus economy did not have access to support services. In Indonesia, the vast majority of survey respondents said they did not have access to these services.

A significant number of respondents also said that they were not interested in accessing these services. This finding demonstrates the need for further research and investigation into reasons why MSMEs may not see a need to access support services. Potential reasons for this may include a lack of awareness of the requirements needed to access these services, and the benefits of seeking support.

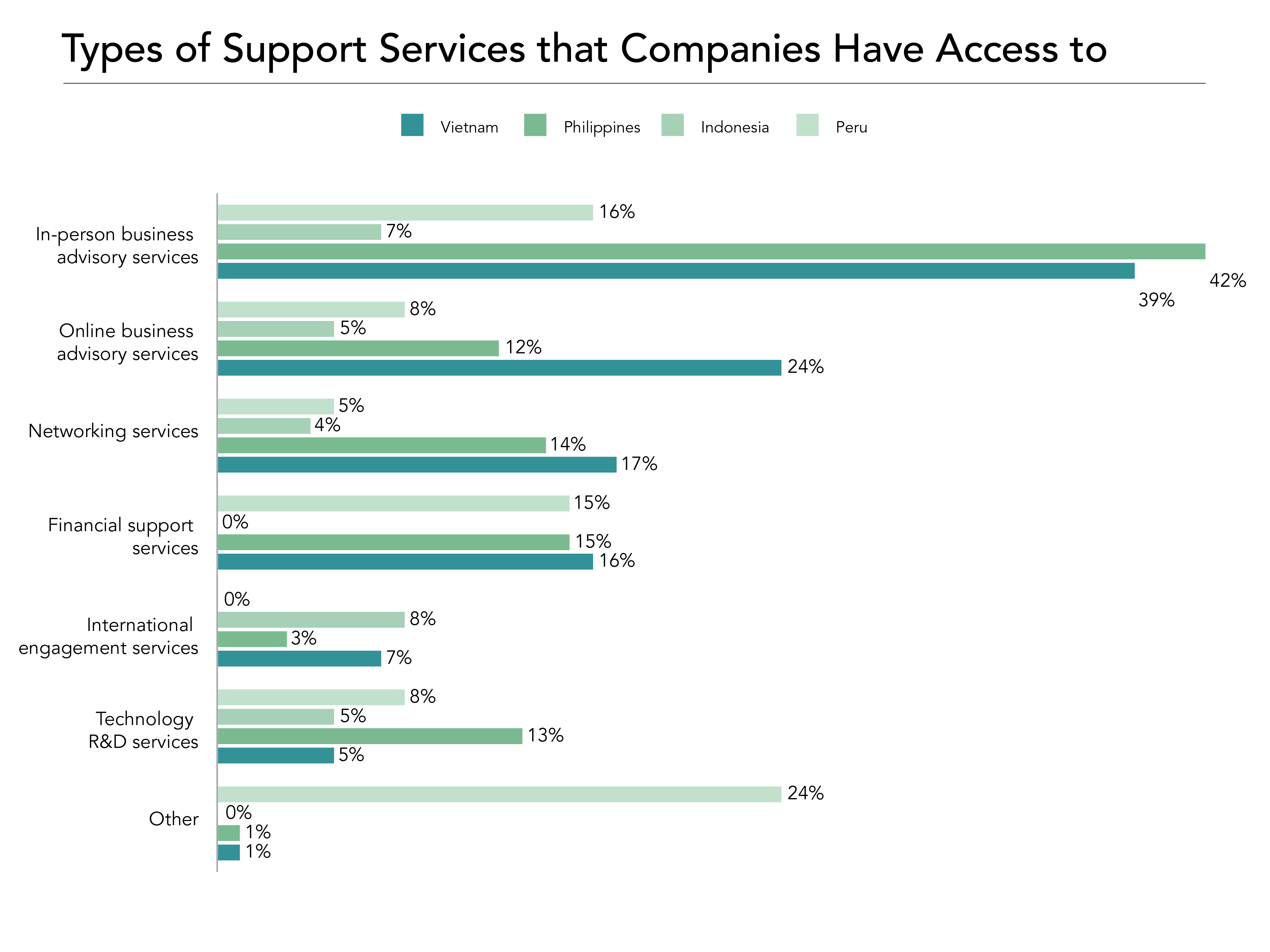

For survey respondents who said they did use some support services, the most commonly accessed one is in-person advisory services, particularly for respondents in Vietnam, the Philippines and Indonesia. This demonstrates that survey respondents from these economies are more accustomed to physical appointments and offices, which may pose an issue in the transition to online or distanced advisory services during the pandemic.

The Partnership recommends that government and business actors ensure that entrepreneurs are made aware of the online alternatives to physical advisory services, and are given the necessary support in accessing these services.

Considering the usage of online business advisory services, the highest rate of usage can be found in the Vietnam survey population (21 per cent). This number is especially significant given that the survey was taken in 2017, and there is potential for an increase in usage since that time. However, the low usage of online advisory services in other economies prompts consideration of how to make the transition to these services accessible and effective during the pandemic.

Also considering the usage of financial services, given the issue of financing, only a minority of respondents said they used services meant to help MSMEs find new sources of financing. Notably in Indonesia, close to no respondents said they used financial services.

Overall, the Partnership recommends that government and business community actors must ensure awareness of these services, particularly online resources in lieu of physical advisory services, to address pertinent barriers for MSMEs like financing. Actors can increase awareness of these services through dissemination among business associations, entrepreneurial ecosystem actors, and MSMEs themselves.

2. Access to government MSME support initiatives

2. Access to government MSME support initiatives

Similar to the low usage of general business support services, our data also shows a consistently low level of awareness of the types of government-provided support for MSMEs. The Partnership’s national surveys asked entrepreneurs about specific government-provided MSME support and export policies in the Philippines, Peru and Indonesia.

In the Philippines, at least a third of respondents said they were unaware of various policies and legislation that support entrepreneurship. For example, over a third of respondents said they were unaware of the Go Negosyo Act, a key piece of legislation that established 'Go Negosyo Centers’ which provide entrepreneurs with a one-stop shop for business support services.

Similarly, in Peru, at least half of respondents said they were unaware of the majority of MSME support programs that were asked about in the survey. Crucial online platforms that serve as information and applications hubs for various government-provided support services, like Produce Virtual and the Digital Kit, are especially underutilized by Peruvian entrepreneurs.

On the other hand, relatively more Indonesian respondents said they were aware of government support programs. The most well-known program is the Entrepreneur Program provided by the Ministry of Cooperatives and MSMEs. However, despite the seeming widespread knowledge of this program, just three per cent of respondents utilized it, while three-quarters said it was not relevant to their program.

While the Partnership’s national survey in Vietnam did not ask entrepreneurs about government-provided MSME support policies, some key examples of these policies include the following

The Partnership strongly recommends that government and business actors review the promotion and accessibility of MSME support services and initiatives, as well as target promotion to specific demographics of entrepreneurs, including women and youth. Without awareness of these services, these vital resources that could build entrepreneurs’ and MSMEs’ capacity will continue to be underutilized.

Policy Recommendations

-

Ensuring widespread knowledge of MSME support: Review the marketing, promotion and accessibility of support initiatives, toward making sure that more MSMEs are aware of the support and resources available to them.

-

Targeted promotion toward specific groups: Ensure that the promotion of support services is targeted, first toward specific demographic groups that are less likely to seek out or receive this information, such as women and youth entrepreneurs, and second toward entrepreneurs in specific industries, with information on the fit of MSME support to their MSME. Disaggregated data on usage of MSME support will be crucial for this effort.

-

Coordinated promotion: Strong co-ordination between the private sector, all levels of government, and MSMEs themselves is crucial toward effectively disseminating information on MSME support.

-

Making MSME support an integral policy: Incorporate plans and investment for MSME support services into national industry support plans, which could save government resources and reduce policy overlap for more efficient delivery of services

Relevant Policies

ADB Asia Small and Medium-Sized Enterprise Monitor: A resource to support developing member countries design evidence-based polices for MSME development in Asia and the Pacific. It provides analyses on the MSME sector, finance, and policy interventions; exchanges best practices and experiences on MSME development; and presents comparative data on MSMEs.

OECD and Southeast Asia Regional Policy Network on Small and Medium Enterprises: A policy network facilitated by the OECD Southeast Asia Regional Programme to share resources on policy areas including trade, environment and digital economy.

Enterprise Policy Responses to COVID-19 in ASEAN: Measures to boost MSME resilience: A 2020 report published by ASEAN and the OECD on key policy responses to support MSMEs during the pandemic in ASEAN economies.

One year of SME and entrepreneurship policy responses to COVID-19: Lessons learned to “build back better”: A 2021 report from the OECD that analyses the diverse SME and entrepreneurship policy measures implemented since the start of the COVID-19 pandemic, to identify implications for policy moving forward.