Financing

The supreme decree creating the special program for the financial support for MSMEs – PROMYPE includes market mechanisms that facilitate access to financial markets and formal credit lines (DECRETO SUPREMO No 134-2006 EF).

Financial Technology (Fintech)

![]()

How can technology and innovation help you with financing your business? Technology and innovation in finance help you access capital more easily through finance management software. This software supports businesses to manage assets, control cash flow effectively, and maximize productivity.

Fintech is a dynamic sector at the intersection of financial services and information technologies. In Fintech, financial companies provide capital services and products for start-ups and businesses entering new markets. Fintech is changing the traditional value chain in the financial sector.

Crowdfunding

Crowdfunding takes advantage of the larger audience of the web to raise capital for projects that would otherwise face difficulty when obtaining funding from traditional banks. Crowdfunding websites make it easy for an average person to invest a small amount in an exciting project. If the business can attract a large number of small investors, it can still raise a significant amount of capital.

Crowdfunding is used by both individual start-ups and MSMEs for new projects. Entrepreneurs use crowdfunding when they are raising capital and as an initial launch funding before looking for more massive loans and investors. Attracting a large crowdfunding-audience can show that a market exists for a new product, and can refine an idea with market feedback before investing money in production.

| Crowdfunding websites - International | Crowdfunding websites - Peru |

|---|---|

| Indiegogo | Thaski – Seed capital program |

| Kickstarter | |

| GoFundMe | |

| RocketHub | |

| Crowdfunder | |

| Ulule | |

| Funding Circle |

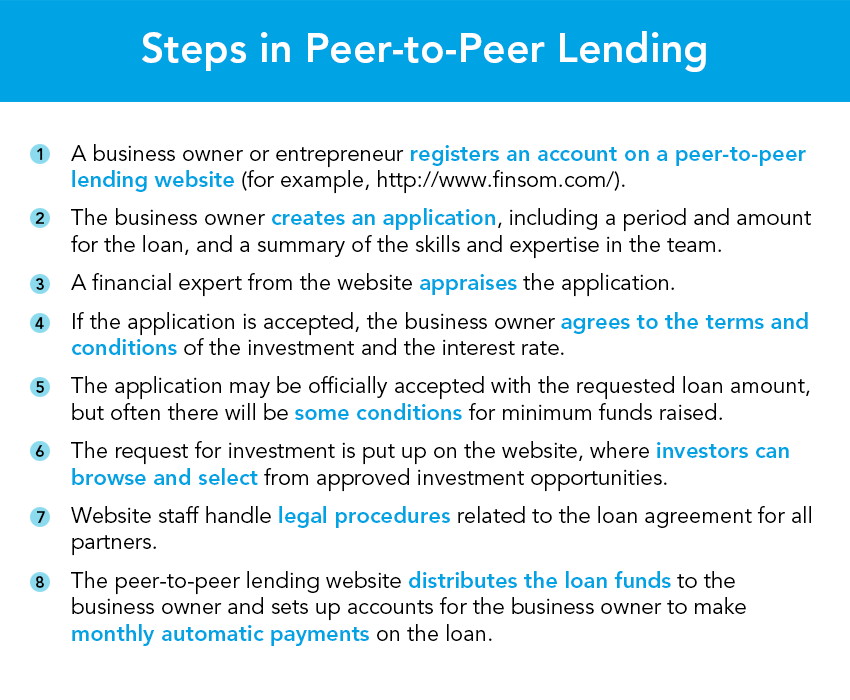

Peer-to-peer lending

Peer-to-peer lending websites create successful direct connections between people who have money to lend those who need loans. These platforms help businesses connect with funding without intermediary lending agencies.

Peer-to-peer lending websites in Peru:

Afluenta is a marketplace lending company in Latin America that connects borrowers with investors.

LatinFintech provides online consumer loans through its technological platform.

Fintech: Managing Your Money

Mobile payment applications available in Peru

Pago Móvil con Visa (Visa Mobile Pay)

CULQUI allows you to collect multiple payments.

AGENTECASH offers financial services in remote and rural zones.

WePayU connects people who need cash from their credit card with students that pay University with cash.

PaQay allows you to pay with your credit card using your cellphone.

Altoke

MiCambio

LaMagica is a digital alternative to a bank account.

LIGO is a prepaid card provider.

Lending

Kontigo is SAAS provider that allows financial institutions to capture and evaluate clients for credit.

TiendaPago is line of credit for small businesses.

InnovaFunding is a web platform that connects businesses that need financing for sales with a community of people interested in investing, though invoices.

HolaAndy offers online loans in less than one hour.

Independencia offers online lending.

Sofi.la allows MSMEs to sell at credit.

Digital payment and e-wallet applications

BiM

Personal Banking

Online Banking tools and software are available to support individual and business financial management and transactions through banks. These tools also support access to financial information on all mobile devices, even if a computer is not available. This makes money management more comfortable and quicker for a business owner.

Personal finance tools available in Peru

Finanzas con O’ Alone allows you to calculate investment indicators, financial ratios, convert rates on an app that has over 100 tools.

Yuntas allows you to organize your money individually or collectively.

UniCuenta integrates a person’s financial information in one location.

AskRobin facilitates financial inclusion and access to just credit.

FactoringLab offers factoring services to Peruvian MSMEs.

ProSol allows you to learn about the origin of your credit, the amounts you need to pay, forms of payment, offers and options available.

Traditional Financial Funding

![]() Access to financing is always essential when starting a new business. In order to access funding businesses may seek out venture capital funds, financial leasing companies, or government innovation and technology support organizations.

Access to financing is always essential when starting a new business. In order to access funding businesses may seek out venture capital funds, financial leasing companies, or government innovation and technology support organizations.

Municipal Savings and Loans Banks (Cajas Municipales de Ahorro y Credito, CMACs)

The Municipal System of Savings and Loans composed by eleven CMACs provides 28,343 points of contact and 80% of microfinance in Peru. You can access more information about the eleven CMACs visiting the following website of the Peruvian Federation of Municipal Savings and Loans Banks. Learn how to obtain credits in less than 24 hours by visiting their websites.

Grants and Funds

COFIDE is a state-owned development bank that performs intermediary financial operations. COFIDE aims to finance investment and development in a sustainable way and supports micro and small businesses with innovative products and services.

Other Peruvian Microfinance regulated banks can be found here.

Emergency Financial Funding

Bill That Declares of National Interest, The Creation of a Financial Rescue Plan for Micro and Small Enterprise Producers, That Have Been Affected by the Natural Disasters of El Niño Costero Phenomenon in Peru (PROYECTO DE LEY No 3665/2018-CR).

Laws Facilitating Investment

Law That Modifies Diverse Laws to Facilitate Investment, Foster Productive Development and Business Growth (LEY No 30056).

Venture Capital Funds in Peru

![]() Venture Capital

Venture Capital

Pecap is the Peruvian association of seed and venture capital.

Peru Venture Capital Conference is Peru’s largest entrepreneurial capital event.

KickStart Peru is a Seed & Discovery Venture Capital Fund based in Peru.

Salkantay Partners Innovate award winners to raise first Peruvian venture capital fund.

Wayra is Telefonica's micro venture fund for startups that have synergies with Telefonica’s business.

Krealo is a corporate venture capital fund with a fintech focus.

Fondo Emprendedor is a new fund for social entrepreneurs. It’s managed by NESsT.

Angel Investments

Angeles Inversionistas are Peru angel investors.

Angel Ventures is a venture capital firm that helps start-ups. It manages syndicated funds and an angel investor network.

The Board Peru is an angel investor network.

UTEC Ventures is an acceleration program and angel investor network.

Emprende UP has different incubation programs and is also an angel investor network.

LIQUID Venture Studio is a venture studio and has different program, including an acceleration service-for-equity program.

bioincuba is an incubator for bio startups.

Impact Investing for Social Enterprises

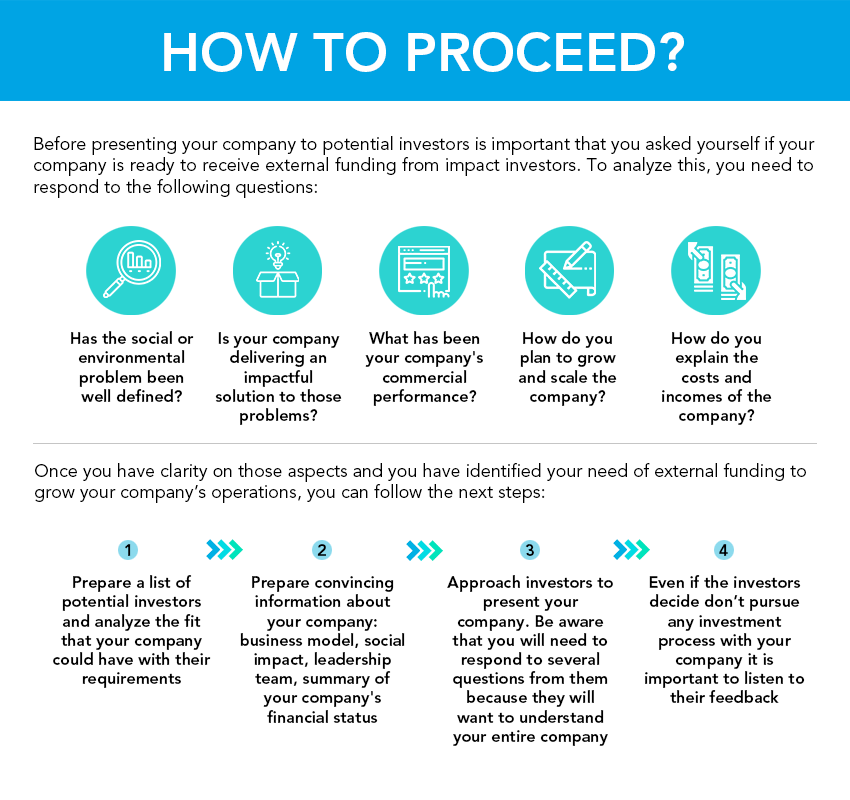

![]() MSMEs that have a business model that includes explicitly social and/or environmental goals have the potential to receive external funding from impact investors.

MSMEs that have a business model that includes explicitly social and/or environmental goals have the potential to receive external funding from impact investors.

Impact investors provide capital to companies, organizations and funds with the intention of generating social and environmental impact along with financial return. If your company has these characteristics will be able to apply to this kind of funds.

Resources

- Agora Partnerships supports impact entrepreneurs with knowledge, networks and capital.

- NESsT provides support to entrepreneurs to develop appropriate metric systems as a part of the technical support to their investees.

- Deetken

- Fledge

- Acumen

- Grassroot Business Fund