Legal Norms

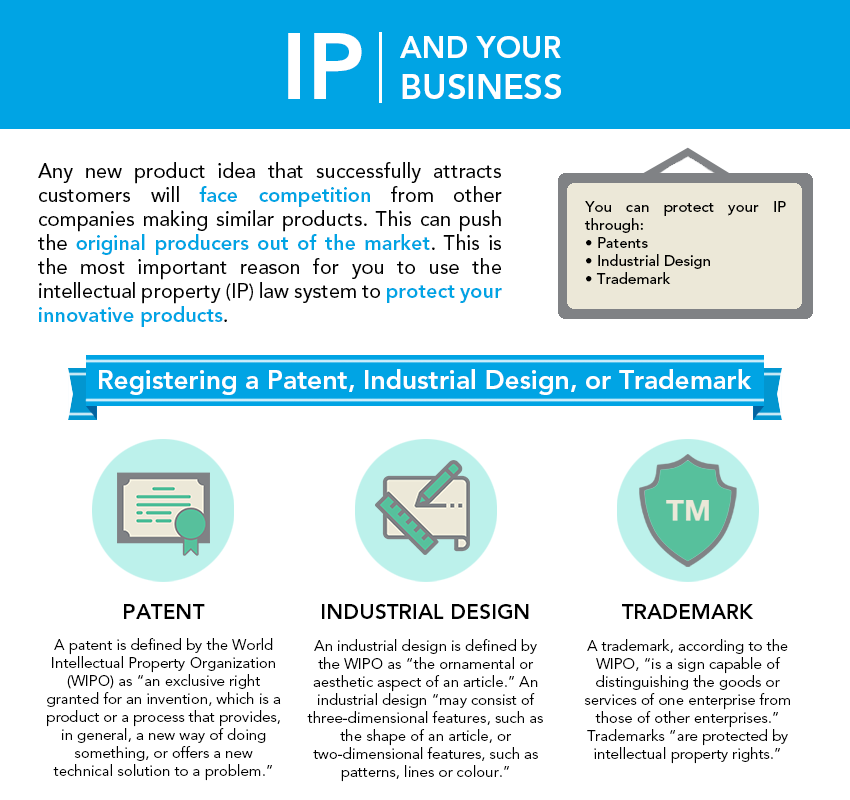

Intellectual Property

![]()

The National Institute of Defense for Competence and Protection of Intellectual Property (INDECOPI) leads the formulation of policy related to intellectual property and works to both prevent and eliminate bureaucratic barriers that can prevent the creation of new enterprises or affect existing ones.

Peru’s Competence Policy was selected in the OECD Competence Committee to be analyzed by experts in other countries with the support of the Inter-American Development Bank.

PATENTA, the National Patent Program of INDECOPI, supports inventors, entrepreneurs, and enterprises to manage the protection of their research, inventions and innovation projects through the Direction of Inventions and New Technologies (DIN).

In 2018, with the support of the World Intellectual Property Organization (WIPO), INDECOPI relaunched their patenting program and implemented 21 CATIs (Centers of Support to Technology and Innovation) at the national level. This is the first effort in Peru to decentralize and foster access to intellectual property information.

Moreover, INDECOPI implemented the Patent Prosecution Highway (PHH) reducing by 35% the time it takes your business to obtain a patent.

Furthermore, INDECOPI introduced a strategy to elaborate with WIPO the National Policy of Intellectual Property and implemented it on the first trimester of 2019. This policy promotes and facilitates the creation, protection, management and use of intellectual property, as a tool for economic, social and technological development.

The Law on Organization and Functions of the National Institute for the Defense of Competition and Protection of Intellectual Property-INDECOPI can be found in this link (LEY No 25868).

Incorporating a Business

![]() To register your business follow these six steps:

To register your business follow these six steps:

1. Search and reserve a business name online

2. Constitutive act preparation (incorporation agreement)

3. Payment of capital goods and assets

4. Public deed (notary)

5. Public records registration

6. Unique Taxpayer Registry (RUC) registration for legal entities and natural persons

7. Legalize your accountant and legal books

8. Open your detraction account in Banco de la Nacion

The Registry of the Micro and Small Enterprise (REMYPE) is a special register designed for micro and small enterprises (MSMEs) that wish to access the benefits of the MYPE Law (Ley MYPE).

MSMEs constituted both as natural or legal entities can access REMYPE if they are involved in the extraction, transformation, production, and marketing of goods or provision of services. In addition, they must have at least one employee (this only applies if the company wants to register in "Registro MYPE Laboral" but not in case of "Registro MYPE Tributario").

Before starting, you should consider the following:

You can register your micro and small business online. All you need is your National Identity Document (DNI) your Unique Taxpayer Registry RUC, username and Clave SOL (this only applies if you want to operate as "Persona Natural con Negocio". If you want to operate as a company, you need to complete the six steps mentioned above). If your annual business sales are under 150 UITs your business is considered a microenterprise. If your annual business sales are anywhere between 150 and 1700 UIT, it is a small enterprise.

The Unique Taxpayer Registry (RUC) is a unique, 11-digit number that identifies a legal entity and natural person as a taxpayer and contains data that identifies all economic activity. It must be used for every process performed with SUNAT, the organization that enforces customs and taxation in Peru. You can apply for an RUC online at the SUNAT website or in person at a SUNAT office or any MAC (Better Citizen Service Center).

To request your Clave SOL, present your ID at any provincial Taxpayer Service Center or MAC Center. You will need to indicate your RUC number. Clave SOL will give you access to services available on the SUNAT Online Operations website.

Brand Background Search

![]() A brand strengthens the business capacity of MSMEs. It represents the identity of a business and adds value to its products and services while attracting customer loyalty.

A brand strengthens the business capacity of MSMEs. It represents the identity of a business and adds value to its products and services while attracting customer loyalty.

Before registering a brand, research the figurative and phonetic antecedents of the elements particular to your brand. This helps identify if other brands have been registered or requested with similar elements. Here, you can access a systematic guide that will allow you to perform a) a phonetics search, b) a figurative search, and c) a search by owner. You can also subscribe here to perform online searches that will save you both time and work.

The Peruvian State website provides information on procedures, services and information. If you click on the Commerce, Business and Entrepreneurship category, you will find information on how to register or set up a company and open for business.

The Peruvian State website also provides information on how to differentiate between a natural person and a legal person and explains what types of companies you can register (corporate name or denomination).

If you decide to register your brand, you will be the only one authorized to use it at a national level. Registering your brand is a very effective way to prevent other people from imitating or copying your product or service.

To look at registered trademarks that might resemble yours, you can do a background check. Here you can perform those searches and search all brands registered or requested by a company or person.

You can register the following types of brands, and each registration is valid for 10 years in Peru:

If you wish to register globally, you need to register in your country of interest.

Regulations on Intellectual Property

World Intellectual Property Organization: Access to intellectual property laws and treaties in Peru

International Property Protection in Peru: Your guide to general information on IP, IP legal base in Peru, International Organizations and Agreements, and Patent Office Contact Details

Examples of IP Protection

If you are an innovator or inventor, you need to understand IP laws and the laws around technology transfer and patents. How have other entrepreneurs protected their IP? Read about these real IP cases and learn about twelve Peruvian success stories provided by INDECOPI.

Important Laws

Ley que fomenta la exportación de servicios y el turismo LEY Nº 30641: Regulates the devolution of taxes in case of exports services of tourism.

Ley de Promoción de la Inversión en la Amazonía - LEY N° 27037: Related to promote the sustainable and integral development of the Amazon, establishing the conditions for public investment and the promotion of private investment in that region.

CÓDIGO DE PROTECCIÓN Y DEFENSA DEL CONSUMIDOR LEY Nº 29571.

Decreto Legislativo que crea el Régimen MYPE Tributario del Impuesto a la Renta - DECRETO LEGISLATIVO Nº 1269.

Ley que regula la responsabilidad administrativa de las personas jurídicas por el delito de cohecho activo transnacional - LEY Nº 30424.

Proyecto de Ley N° 2533/2017-CR, Ley que Regula las Sociedades de Beneficio e Interés Colectivo (Sociedades B.I.C.) http://www2.congreso.gob.pe/sicr/tradocestproc/Expvirt_2011.nsf/visbusqptramdoc1621/02533?opendocument (similar to BCorps)

Ley que promueve la Investigación Científica, Desarrollo Tecnológico e Innovación Tecnológica - LEY Nº 30309.

Ley de protección de datos personales - LEY Nº 29733

Reglamento de la Ley Nº 29733, Ley de Protección de Datos Personales - DECRETO SUPREMO Nº 003-2013-JUS

Law That Modifies Diverse Laws to Facilitate Investment, Foster Productive Development and Business Growth (LEY No 30056)

Law for Promotion and Formalization of the Micro and Small Business (LEY No 28015)

Law on Organization and Functions of the National Institute for the Defense of Competition and Protection of Intellectual Property-INDECOPI (LEY No 25868)

Supreme Decree that Approves the Regulation of LEY No 29051, Law That Regulates the Participation and Election of MSME Representatives in Diverse Public Entities, Modified by LEY No 30056 (DECRETO SUPREMO No 014-2015-PRODUCE)

Supreme Decree that creates the Special Program of Financial Support for MSMEs – PROMYPE that includes market mechanisms that facilitate access to financial markets and formal credit lines to MSMEs (DECRETO SUPREMO No 134-2006 EF) - Modified by Decreto Supremo N° 099-2012-EF.

Legislative Decree That Approves the Law of Promotion of Competitiveness, Formalization, and Development of the Micro and Small Enterprise and Access to Decent Employment (DECRETO LEGISLATIVO No 1086)

Unique Order Text of the Law of Promotion of Productive Development and Business Growth (DECRETO SUPREMO No 013-2013-PRODUCE)

Law That Establishes Dispositions for the Support of Productive Competitiveness (LEY No 29337)

Law That Establishes Measures to Promote Economic Growth (LEY No 30264)

Bill of Constitutional Reform that Recognizes Explicitly the Promotion of Micro and Small Businesses (MSMEs) (PROYECTO DE LEY No 187/2017-CR)

Bill That Declares of National Interest, The Creation of a Financial Rescue Plan for Micro and Small Enterprise Producers, That Have Been Affected by the Natural Disasters of El Niño Costero Phenomenon in Peru (PROYECTO DE LEY No 3665/2018-CR)

Bill of Law that Creates the Control System for Own Revenue Collection in Local Governments (PROYECTO DE LEY No 3687/2017-CR)

The Legislative Decree that Fosters the Strengthening of the Micro, Small and Medium Businesses and Creates the CRECER Fund (DECRETO LEGISLATIVO No 1399), fosters both the productive and business development of the micro-, small- and medium-sized enterprise and exporting businesses, for their high impact in the national economy.

Operating regulations for MSMEs Fund – SEPYMEX. The Small and Medium Enterprise Support Fund promotes access to financing for MSMEs through a coverage program CREDITS FOR EXPORT (before and after shipment) offered by financial institutions to promote international trade. (DECRETO DE URGENCIA No 050-2002)

The Law for the Formalization and Promotion of Small-Scale Mining and Artisanal Mining (LEY No 27651) introduces a legal framework in the Mining Legislation to enable efficient regulation of mining activities carried out by small-scale miners and artisanal miners, thereby assisting their formalization, promotion and development. This law provides mining MSMEs with a promotional regimen that aims to strengthen its national level, improving quality of life for nearby populations by employing local labour.

Bill of Law that Modifies the General Law of Mining (PROYECTO DE LEY No 3791/2018-CR)